Good morning

We’re about 6 weeks away from Moonshot 2024, and people can’t wait—especially last year’s attendees.

This year’s Moonshot promises more content tracks, sessions, mixers, and the most audacious thinkers, doers, and investors in African tech, working on everything from fintech to commerce, renewable energy, climate change, tech policy, AI, telco, cloud and more.

Save a seat at Moonshot 2024. Get tickets here.

M&As

Wasoko and MaxAB finally complete merger

As far as mergers and acquisitions go in Africa’s tech ecosystem, the Wasoko-MaxAB merger is one of the most significant. Both B2B e-commerce companies, with base operations in Kenya and Egypt respectively, have joined forces to create a dominant player in the African B2B e-commerce market.

Talks of an all-stock merger have been ongoing since December 2023. Initially expected to be completed in March 2024, the deal was marred by multiple layoffs, court lawsuits, and delays due to reasons Daniel Yu, Wasoko CEO, claimed were “sensitive.”

Mergers, depending on the nature, typically take six months to complete. However, complications could arise that might take the negotiations well over a year. But both companies will now look to put all that squabbling behind them. Yu and MaxAB CEO, Belal El-Megharbel, will serve as co-CEOs in the newly merged company. New details reveal that the deal is a 50-50 merger.

The merger will combine the strengths of both companies, combining Wasoko’s network of merchants in East Africa with MaxAB’s expertise in B2B beverage supply in North Africa. With this partnership, the combined entity—yet to be renamed—will operate across East, Central, and Northern African regions.

This will allow the combined entity to offer a wider range of products and services to a larger customer base.

Wasoko-MaxAB will focus on raising additional funding—a claim Yu has not denied—cutting costs on non-profitable markets, and growing its buy-now-pay-later (BNPL) product.

B2B e-commerce in Africa has become a difficult beast with funded companies like Copia Global shutting down this year. However, with the combined advantage, Yu and El-Megharbel will be hopeful for a turnaround of their companies’ struggles and growth in their standing in the tough B2B e-commerce climate.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Internet

Kenya’s regulator welcomes Safaricom’s ISP suggestions

Last Thursday, Safaricom, Kenya’s largest internet service provider, argued against granting licences to independent licences to satellite internet providers like Starlink. Safaricom argued that granting independent licences to satellite service providers could lead to harmful interference with existing mobile networks, and compromise national security.

Yesterday, Kenya’s Communications Authority said those concerns are valid and that it will examine them within its frameworks.

At the heart of the issue is Starlink’s growing appeal among users in Kenya. Fast internet speeds, cheap data bundles and a workaround to afford the Starlink kit are among the perks offered to Kenyans.

Starlink’s cheaper service is a new threat to Safaricom whose data revenue helped it achieve profitability in 2023. Other telecoms have also started ramping up marketing campaigns to retain customers.

Any decision made by the CA upon reviewing Safaricom’s demand will be consequential to the users, Starlink, Safaricom and other telecoms in the country.

Unlike other internet service providers, Starink, through a satellite connection, is able to provide internet service even in the most remote parts of Kenya. A move to block independent satellite providers could jeopardise Kenya’s hard-won improvements in internet accessibility. Users will also have fewer (expensive) alternatives to choose from if the CA moves to block independent satellite providers.

Collect payments anytime anywhere with Fincra

Are you dealing with the complexities of collecting payments from your customers? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. What’s more? You get to save money on fees when you use Fincra. Get started now.

Mobility

Bolt reintroduces car loans amid drivers’ demand for increased base fare

When a President visits, the whole city grinds to a halt. Certain roads are blocked and traffic diversions are made. While diversions are important to keep traffic at bay, they are also an important tactic for businesses.

Yesterday, Bolt reintroduced car loans in Kenya, steering the conversation away from drivers’ calls for lower commissions and higher base fares.

Drivers had previously gone on a five-day strike, requesting an increase in base fare. Those drivers went as far as imposing their own prices on riders and harassing them when they didn’t oblige. However, Bolt’s novel idea to quell the outrage was a reintroduction of its car loan.

The car loan was first introduced in 2019, however, a lack of traction (fueled by the COVID-19 lockdown) led to an end of the venture. While Bolt has not shared much information about the latest interaction of the car loans, it last offered drivers vehicles at 1.2 million KES ($9,302). Drivers were expected to pay back within 36 months at an interest rate of 22.5%.

While the car loans offer a convenient way for drivers to own vehicles, drivers say they don’t want the deal as asset financing faces more scrutiny on the continent. Kenyan drivers claim their earnings were insufficient to cover repayment and vehicle maintenance costs.

Companies

Jim Volkwyn steps down from MultiChoice board

The responsibility of board members is toward a company’s best interests. But what happens when these members consult for the same company on pure financial interests? If the company makes a bad business decision as a result of an ill-advised consultation, who takes the fall?

These are questions that the Public Investment Corporation (PIC), South Africa’s government investment arm, is asking Multichoice and its board member Jim Volkwyn.

PIC, the second-largest shareholder in MultiChoice after Vivendi, has questioned the company’s tradition of involving board members as consultants in its operations. Volkwyn was paid R10 million ($565,000) in his six-year tenure as a consultant. Former board chair Imtiaz Patel also reportedly earned R20 million ($1.12 million) in a similar consulting role before stepping down from the company in April 2024.

The shareholder also claimed that the streaming company acted alone in its decisions and did not inform shareholders. However, MultiChoice has denied this claim stating that Volkwyn’s consultancy arrangements (including his financials) were made transparent to all shareholders in the company.

In its defence, MultiChoice also issued statements claiming that it was cheaper to hire board members as consultants due to their experience in the pay-TV industry compared to outsiders. Volkwyn, the company’s longest-serving board member, was formerly the CEO of MultiChoice when the streaming company was under Naspers, a South African-based tech conglomerate.

Volkwyn has now stepped down from the board over allegations of breaching corporate governance principles, ahead of the company’s Annual General Meeting on August 28, 2024. He will not be seeking re-election to the board, effectively avoiding what could be a showdown hogging media headlines in the coming weeks, or worse, tanking MultiChoice’s market standings.

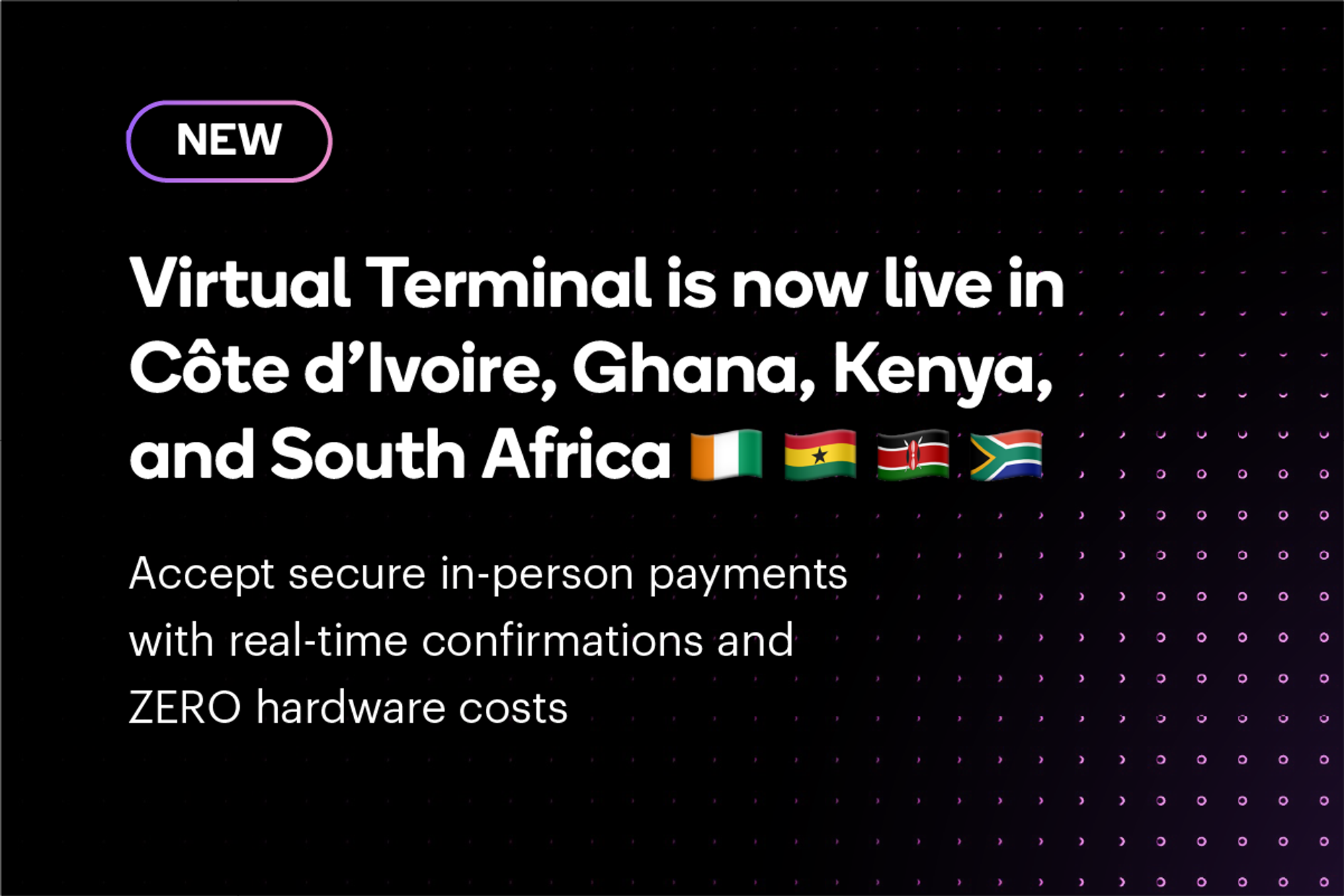

Paystack Virtual Terminal is now live in more countries

Paystack Virtual Terminalhelps businesses accept secure, in-person payments with real-time WhatsApp confirmations and ZERO hardware costs. Enjoy multiple in-person payment channels, easy end-of-day reconciliation, and more. Learn more on the Paystack blog →

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $59,843 |

– 5.71% |

– 14.1% |

|

| $2,477 |

– 7.86% |

– 25.9% |

|

|

$5.33 |

+ 1.56% |

– 36.43% |

|

| $148.08 |

– 6.42% |

– 23.25% |

* Data as of 05:45 AM WAT, August 28, 2024.

Events

- The Central Bank of Nigeria is conducting a survey to gather insights from fintech operators on their scope of activities, key issues, and challenges facing the industry. Your perspective as an operator is important to this study. Please take a moment to complete this survey.

- We’re excited to announce our partnership with Wimbart the second edition of their pioneering pan-African research publication, “Startup Performance Reporting in Africa”. This report will shed light on the intricacies of investor relations within the African tech ecosystem. If you’re a founder, take a couple of minutes to share some key insights with us by filling out this survey.

- The Africa Prize for Engineering Innovation is open to African innovators creating engineering solutions to local challenges. Innovators from sub-Saharan Africa should pitch viable engineering products or services that will have social or environmental benefits to the continent. Apply for the chance to get up to $25,000 in funding.

- The Future of Capitalism Tech Startup Competition is offering $1 million to one lucky tech startup that can transform how businesses today operate. If your tech can save costs, boost efficiency, increase productivity or customer satisfaction, then apply by September 30 for a chance to win.

Written by: Faith Omoniyi, Stephen Agwaibor & Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/MDXLkQJ

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon