Welcome to the first Monday of Q4.

TechCabal’s My Startup in 60 Seconds gives founders a one-minute spotlight to share their entrepreneurial journey, from vision, challenges, and big wins. You can put your startup in front of investors, potential customers, and the wider Africa’s tech ecosystem.

This isn’t just visibility; it’s your chance to connect with the people who matter most to your growth.

Click here to be featured in My Startup in 60 Seconds or explore other TechCabal advertorial opportunities, and let the ecosystem hear your story. Please note that this is a paid opportunity.

Streaming

Canal+ wants to export African content

Now that Canal+ owns MultiChoice, the French broadcasting giant wants to sell South African-made content abroad. The plan is to push MultiChoice original productions through StudioCanal, its distribution arm that already spends about $234 million annually on films and series, and slot them into markets where foreign stories already have traction.

Why is this important? Canal+ views South Africa’s production ecosystem as increasingly skilled. MultiChoice spent over $1 billion on content in its last financial year. Canal+ bets that it can secure high-quality content and leverage South Africa’s production costs to distribute globally marketable series at lower prices, while reselling them to dollar- and euro-based markets that seek diverse stories.

Multichoice has tried to play the global game. Showmax was available in Australia, Europe, New Zealand, and North America for eight years, catering to expatriates and interested foreigners. But, in 2023, after struggling against streaming rivals like Netflix and Amazon Prime Video, the service was shut down to everyone outside Africa. MultiChoice cited that it had made the “strategic decision” to focus on the African market.

Canal+, the saviour. Canal+ already controls a global sales pipeline, with over 400 million monthly active users on its video streaming platforms. The broadcasting giant is leaning into licencing and syndication, selling the same productions into overseas markets where StudioCanal already has a strong presence.

ICYMI: The distributor intends to introduce licencing content from American companies, while continuing to invest in MultiChoice’s sports and entertainment content.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Companies

Meta and NDPC opt for settlement over privacy fine

Meta, parent company of WhatsApp, Facebook, and Instagram, is negotiating a settlement with Nigeria’s Data Protection Commission (NDPC) after being fined $32.8 million.

How we got here: The penalty followed an investigation that accused Meta of processing Nigerians’ personal data without consent, running behavioural ads, breaching cross-border rules, failing to file compliance audits, and even handling the data of non-users. Along with this fine, the regulator issued eight corrective orders specifying required corrective actions, were issued to Meta.

Meta fired back. The company argued that it never got a fair hearing and asked the court to throw everything out. The NDPC countered by describing Meta’s claims as defective and incompetent.

The turnaround. The NDPC initially denied any settlement talks, insisting it would fight in court. The court was set to rule, but at a recent hearing, both sides surprised the judge by confirming draft terms had been exchanged.

What does this mean? The case matters because it is one of the first major enforcement tests of Nigeria’s 2023 Data Protection Act. Although the NDPC has already tested its power with African firms like MultiChoice, Meta was the first big foreign target. The case sets a precedent for other global companies operating in Nigeria. In this market, data protection is not optional.

Paga is in USA

Big news! Paga is now live in the United States, with digital banking services designed for Africa’s diaspora! Eligible users can send, pay, and bank in US Dollars & Naira, safe, regulated, and borderless. Learn more.

Cryptocurrency

Kenya edges closer to crypto regulation

Kenya is on the verge of rewriting the rules of its digital economy. The National Assembly has approved the Virtual Asset Service Providers (VASP) Bill at the committee stage, clearing the way for its final reading before President William Ruto’s assent. Once passed, the bill will give Kenya a clear regulatory path for cryptocurrencies, tokenisation, and digital asset services.

What’s new? The VASP Bill puts the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) in charge of oversight, while the Treasury will design detailed rules. These will cover stablecoins, tokenised assets, trading platforms, cybersecurity, advertising standards, and anti–money laundering compliance.

Between the lines: Kenya ranks among Africa’s top five crypto markets, driven by remittances, peer-to-peer trading, and fintech adoption. Blockchain analytics firm Chainalysis estimates that Kenya handles hundreds of millions of dollars in crypto transactions each year, much of it through informal channels. Clear rules could allow local startups and global exchanges to operate openly, building trust and access to capital.

Zoom out: Across the continent, regulators are moving in the same direction. South Africa has licenced more than 240 crypto firms, Nigeria has created a sandbox for digital asset regulation, and Mauritius already enforces global standards.

The big picture: Kenya’s move signals a new phase for East Africa’s digital economy—one where crypto is no longer a fringe experiment but a key part of its financial future.

Paystack introduces Pay with Bank Transfer in Ghana

WithGhanaian businesses can now accept secure, instant bank transfers on Paystack. Learn more here →

Economy

Egypt cuts interest rates again

The Central Bank of Egypt (CBE) has lowered its key interest rates by 100 basis points across the board. The overnight deposit rate is now 21%, the lending rate 22%, and the main operation rate 21.5%. The discount rate also drops to 21.5%.

Between the lines: It is the second rate cut in a row (and as we predicted), it’s the latest signal that Egypt is entering a new phase of monetary easing after over two years of a tightening cycle. Inflation, which reached 25% in January 2025, has continued to slow—12% in August—as the pound stabilises and food prices ease. This shift gives policymakers more room to support growth and ease pressure on borrowers.

What this means: For businesses and consumers, lower rates could help unlock credit and stimulate investment, especially in sectors like construction, retail, and manufacturing that were hit hard by expensive financing. The CBE is expected to move carefully to keep the pound stable and maintain investor confidence.

Zoom out: The decision also fits into the government’s wider effort to balance inflation control with growth targets under its reform plan supported by the International Monetary Fund (IMF).

Flash Sale: 25% Off Moonshot Tickets

Flash Sale: 25% Off Moonshot Tickets

For a limited time only, you can save your seat at Africa’s biggest tech gathering with an exclusive 25% discount. On October 15 & 16, the Eko Convention Centre in Lagos will host founders, investors, policymakers, creatives, and operators shaping Africa’s innovation economy. Moonshot 2025 will feature deal rooms, investor lounges, immersive exhibitions, and the TC Startup Battlefield. Moonshot 2025 is designed for real connections and lasting impact. This offer ends soon.

Secure 25% off your Moonshot ticket now. Get tickets.

Secure 25% off your Moonshot ticket now. Get tickets.

SPECIAL NUMBER

25%

Starting in 2026, profits from cryptocurrency trading in Nigeria will be taxed like regular income, up to 25%. Under the new tax law, annual profits below ₦800,000 ($545) will be exempt.

Unlike before, only net profits will be taxed, meaning traders won’t pay anything when they record losses. The law expects traders to self-report their income. In instances where they don’t, crypto operators are mandated by the law to monitor and report transactions to the tax master.

Learn more about the Nigerian government and its many money-making schemes in this week’s Follow The Money column. Every Monday, TechCabal unpacks the most important earnings, business models, and growth strategies shaping the future of Africa’s tech ecosystem.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $124,029 |

+ 1.12% |

+ 11.76% |

|

| $4,532 |

+ 0.90% |

+ 4.74% |

|

| $0.002703 |

– 0.01% |

+ 149.01% |

|

| $231.26 |

+ 1.57% |

+ 12.96% |

* Data as of 03.00 AM WAT, October 6, 2025.

Events

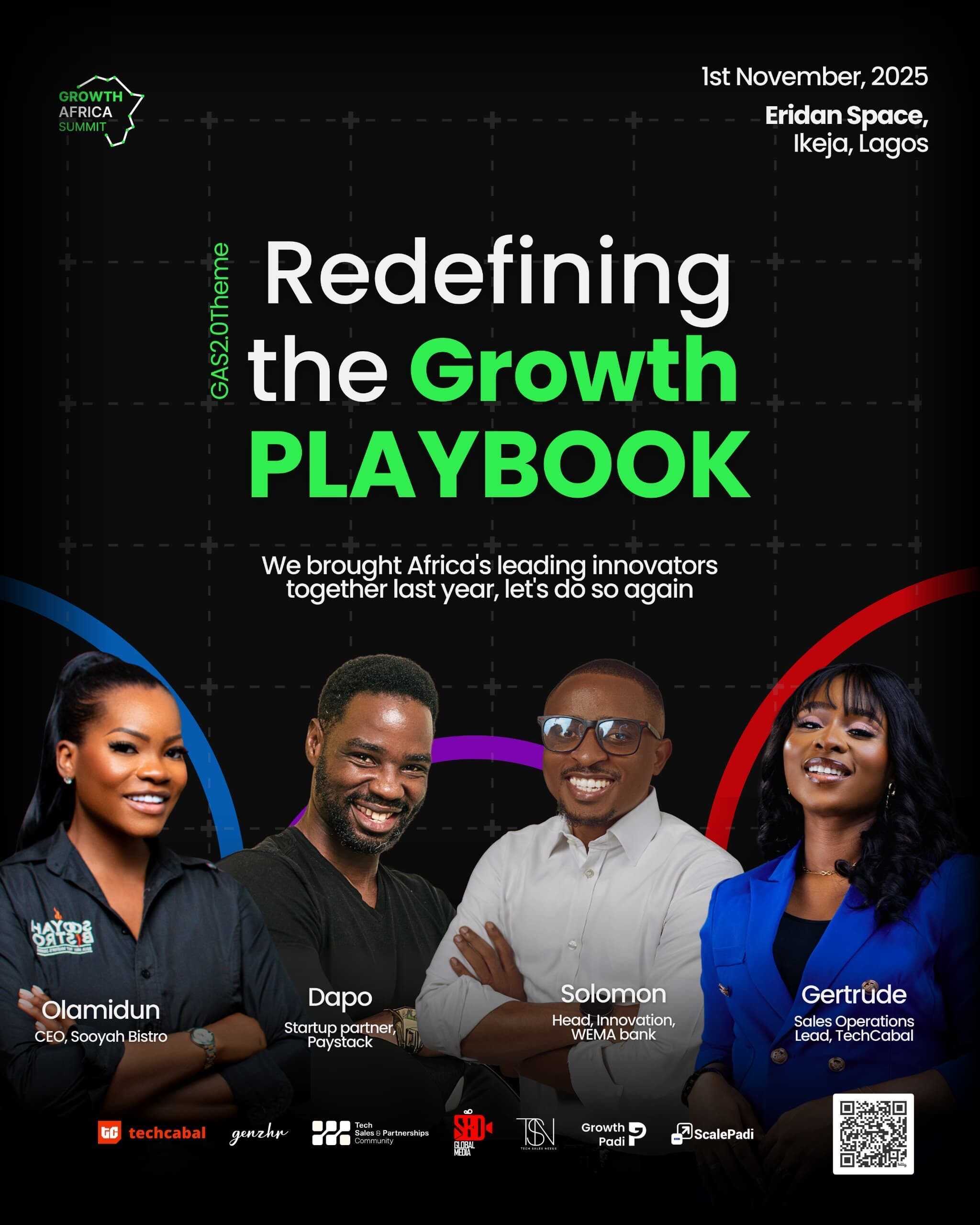

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

Written by: Opeyemi Kareem and Emmanuel Nwosu

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/PdTaqlF

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon