DStv subscriptions in Kenya dropped to 188,824 by June 2025, from 1.2 million in the previous year, according to the latest data from the Communications Authority of Kenya (CA). GOtv, also owned by MultiChoice, fell to 314,520 from 2.8 million over the same period.

These losses account for most of the 77% contraction in Kenya’s broadcasting market in the past year, a sign that households are leaving traditional pay-TV at a record pace.

Digital terrestrial TV, where GOtv operates, saw the steepest fall, with total subscriptions down 89% year-on-year. StarTimes, one of its rivals in Kenya, dropped to 492,330 from 1.7 million.

Direct-to-home satellite subscriptions also fell 67%, with DStv posting the largest decline. Wananchi Group’s Zuku cable business was the only major provider to grow, up 20% to more than 64,000 subscriptions.

MultiChoice has raised subscription fees five times in three years. DStv Premium, its flagship bouquet, costs about KES 11,700 ($91) per month today, up from KES 7,500 ($58) in 2022. At least five customers told TechCabal that they are unwilling to keep absorbing those increases, particularly when cheaper alternatives exist.

“Take away the bars, restaurants, a few offices, and the neighbourhood football shacks, and there’s no one left,” said Paminus Osike, a former DStv customer. “The moment they started selling dishes on the street, it was clear where things were headed.”

Netflix, which starts at KES 200 ($1.55) monthly for its mobile plan and KES 1,100 ($8.5) for its premium plan, does not offer live sports but has become a popular replacement for general entertainment.

Showmax, owned by MultiChoice, currently charges KES 520 ($4) per month for its entertainment plan. Until early 2024, Showmax Pro offered Premier League and other sports on TV screens, but MultiChoice shut it down and replaced it with a mobile-only sports streaming plan at KES 450 ($3.5) per month, which several former DStv customers say is less appealing for households used to watching football together on TV.

Piracy is another pressure point. Football matches and premium shows are widely available on illegal apps and websites. With MultiChoice’s current Premier League broadcasting rights expiring this year, some Kenyan viewers say they would welcome MultiChoice stepping back from renewing, arguing that the rights no longer deliver enough viewership to justify the price increases that follow each renewal.

Bars and hotels remain among the last heavy users of DStv, but even they are experimenting with cheaper or unauthorised solutions as margins tighten.

The shake-up comes as French broadcaster Groupe Canal+ finalised its takeover of MultiChoice, acquiring shares at R125 ($7.20) to secure 46% control, with more acceptances expected.

The deal gives Canal+ and MultiChoice a combined base of over 40 million subscribers across nearly 70 countries. Kenya’s steep decline, though, underscores the challenge of holding onto premium satellite customers in a market that is moving toward streaming, free-to-air TV, and illegal feeds.

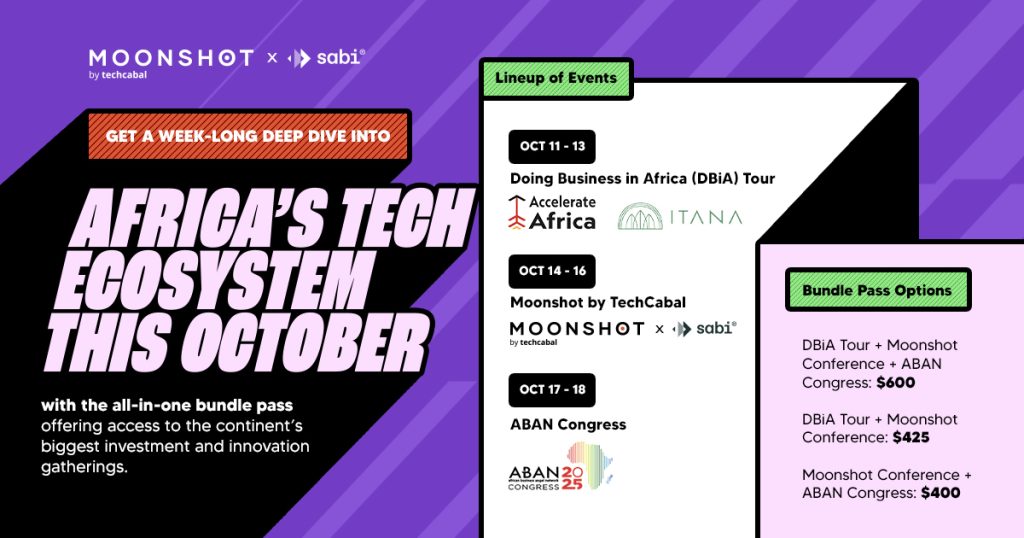

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Meet and learn from Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Get your tickets now: moonshot.techcabal.com

from TechCabal https://ift.tt/9YXs0KS

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon