Wazzup.

Billionaire tech chad Elon Musk has been catching all sorts of strays this week. From his very public, very messy argument with OpenAI’s Sam Altman (again) and Grok’s gaffe, to another executive stepping down in xAI’s ranks. This time it’s Igor Babuschkin, who’s leaving to start his venture capital firm—right as Grok, xAI’s social-media-native chatbot, faces mounting ethical criticism.

In Memphis, Tennessee, residents are taking Musk’s data centres to court, claiming the facilities, which sit a few miles from their homes, are fouling the air and water. It’s a reminder that we often obsess over the cool, shiny side of tech but rarely think about the mess it leaves behind. On a lighter note: is anyone out there working on hyperscale data centres in Antarctica? Asking for a planet.

Let’s get into it.

Telecoms

Globacom risks NCC sanction over CEO role

It’s not every day you see a company struggle—or feel pressured—to fill its CEO role.

Globacom, Nigeria’s third-largest telecom company, now has 24 months to find a new CEO or face the wrath of the Nigerian telecom regulator.

The countdown started after the Nigerian Communications Commission (NCC) dropped new governance rules on August 7, 2025, aiming to make telecom boards more transparent, accountable, and less like a game of musical chairs with only one chair.

The rules are simple: the chairman and CEO must be two different people. MTN Nigeria, Airtel, and 9mobile have already ticked that box. Globacom, meanwhile, is still playing the corporate equivalent of “I can do it all,” with founder Mike Adenuga wearing both hats since day one.

ICYMI: In 2024, the company tried to shake things up by hiring seasoned telecom exec Ahmad Farroukh. It lasted two months before disagreements sent him packing.

Now, the NCC says the chairman must be a non-executive director, can’t double as CEO, and the board must have independent members who are knowledgeable about their ICT from their IoT. Ignore the rules, and Globacom could face fines, forced leadership changes, or even a licence suspension.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

M&A

South Africa’s Nedbank gets approval to acquire iKhoka

It’s raining acquisitions in South Africa.

In the telecom space, the much-talked-about Vodacom-Maziv merger is nearing completion after a conditional approval. Yesterday, Cell C also received approval to acquire Blue Label’s CEC.

The startup space is not left out, either. In May, Lesaka Technologies acquired neobank Bank Zero in a R1.1 billion ($61 million) deal. In that same vein, Nedbank, South Africa’s fourth-largest commercial bank by assets, has acquired iKhokha, deepening its paws into digital payments for businesses.

iKhokha will operate as a wholly-owned subsidiary, keeping its brand, leadership, and entrepreneurial culture under a management lock-in. With Nedbank’s resources, regulatory backing, and customer reach, it will speed up launches of new payment solutions, SME credit products, and business management tools, while exploring expansion into other African markets.

The deal, an all-cash transaction worth R1.65 billion ($94 million), marks one of the few examples of South African commercial banks buying fintechs. In 2019, Capitec—now the country’s fifth-largest bank—acquired Mercantile Bank, which had pivoted to digital business banking.

Why does this deal make sense? Nedbank gains a fast track into the SME economy, a segment that drives most employment and billions in revenue but still leans heavily on cash. iKhokha’s mobile point-of-sale (PoS) devices, business tools, and payments infrastructure slot directly into Nedbank’s offerings, creating a ready-made fintech arm. Its alternative credit scoring uses transaction data to unlock loans for underserved SMEs, aligning with Nedbank’s lending push and financial inclusion goals.

With R20 billion ($1.1 billion) in annual payments and R3 billion ($171 million) in SME loans, iKhokha brings both growth potential and a competitive edge. It positions Nedbank ahead of rivals without an integrated SME ecosystem of payments, credit and analytics, while deepening its stake in the more nimble fintech market.

Paga Engine powers the boldest ideas in Africa

You’ve got customers, but do you have the right infrastructure in place? Don’t let outdated systems hold you back. Paga Engine is the fintech backbone built for businesses like yours. Read the full article.

Mobility

Xiaomi to launch flagship EV in South Africa

In more South African news, Xiaomi will launch its fastest electric car, the SU7 Ultra, in South Africa in the coming months.

While the company is yet to announce a launch date or pricing, the flagship vehicle is one the Xiaomi’s fastest electric vehicles (EVs). So quick that it beat Tesla’s fastest electric car—the Model S Plaid—and the Rimac Nevera.

What’s the spec? The Ultra runs a 94 kWh battery with up to 630 km range and charges from 10% to 80% in 11 minutes at 490 kW. International pricing starts at about $114,000, while the entry-level SU7 Standard sells for roughly $30,400.

Xiaomi’s EV track record is short but sharp. Its YU7 SUV drew 200,000 pre-orders within three minutes earlier this year, showing the company can move metal as quickly as it moves phones. The company hasn’t said if the YU7 will follow the SU7 Ultra into South Africa.

Zoom out: Xiaomi’s arrival adds another heavyweight to South Africa’s growing EV roster. German brands BMW, Audi, Mercedes-Benz, and Volvo dominate the premium end of South Africa’s EV market, while Chinese makers are accelerating in BYD, Chery (Omoda/Jaecoo hybrids), Great Wall Motor, GAC, BAIC, and Changan, which will arrive later this year. Stellantis will debut Leapmotor EVs in September 2025.

With Tesla absent from the market and Chinese brands expanding quickly, the SU7 Ultra could be a statement entry, one that tests whether local buyers are ready to spend big on performance EVs.

The Paystack guide to handling disputes at scale

Learn how Paystack manages chargebacks and fraud claims across multiple markets. Read here →

Economy

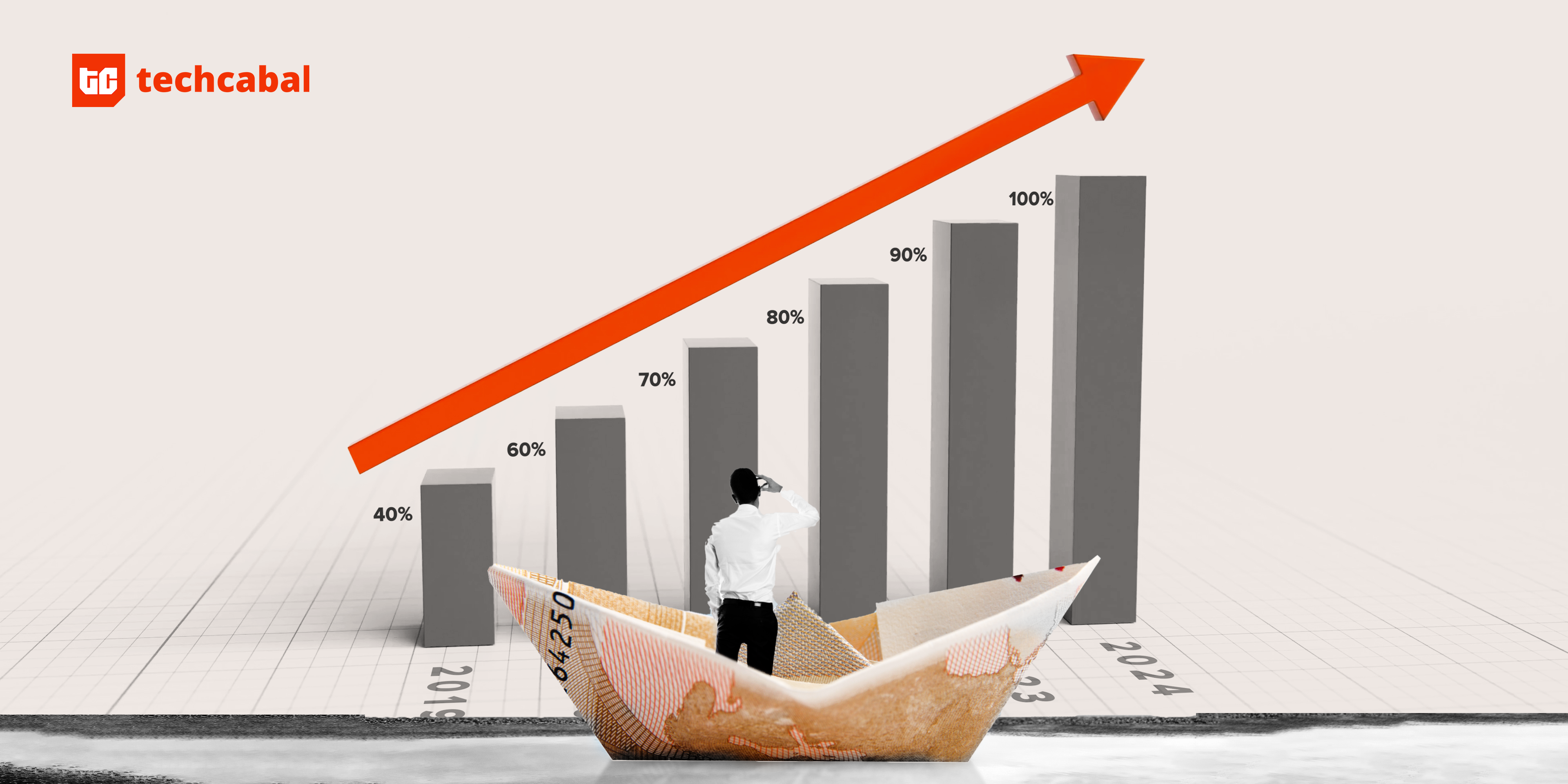

Kenya’s Central Bank cuts benchmark rate to 9.50%, seventh time in a row

The Central Bank of Kenya (CBK) seems to have forgotten how to hit the brakes on cutting benchmark rates.

On Wednesday, it cut the key interest rate by 25 basis points (bps) to 9.50%, marking the seventh consecutive cut since November 2024.

State of play: If you’re wondering why the CBK has been bullish on rate cuts, it is for two reasons: first, inflation has been easing steadily, giving the bank room to make borrowing cheaper without pushing prices up. Second, the CBK wants to spur credit growth and revive economic activity in sluggish sectors.

Catch up: The CBK needs the participation of banks as it continues a free-fall on the benchmark rate. If the banks don’t lower lending rates, the cost of borrowing won’t come down, and that gets in the way of the CBK’s goal for the economy.

While, for months, this has been a contentious issue between the CBK and the banks, the consistent behaviour of the regulator has given lenders more confidence.

The CBK is throwing a Christmas party that doesn’t seem to end. Its rate-cutting streak will depend on how inflation behaves in the coming months and how quickly the economy responds to the cheaper credit.

If price stability holds, the CBK could keep trimming. But if inflation flares up again, it’s party over for rate cuts in Kenya.

Launch Africa’s Next AI Startup. Start at Mest.

IApplications are open for MEST’s fully funded AI Startup Program. Train with Global Experts | AI – focused | Incubation | Seed Funding Potential | Apply by August 22 → #MESTAI2026

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $122,760 |

+ 2.87% |

+ 4.88% |

|

| $4,732 |

+ 2.09% |

+ 59.65% |

|

| $0.9882 |

+ 16.68% |

+ 36.25% |

|

| $208.02 |

+ 5.47% |

+ 30.00% |

* Data as of 06.45 AM WAT, August 14, 2025.

Events

- Bridge And Value and AlexBoyo World (ABW) are hosting a bespoke trade mission to Paris for Nigerian businesses looking to scale into France and the wider European market. From September 22–26, 2025, participants will attend the Spotlight Nigeria Business Forum (8th edition), Europe’s premier Nigeria-focused summit, and BIG 2025, Bpifrance’s flagship entrepreneurship event. The itinerary also includes high-level business meetings, networking sessions with French investors and institutions, and a guided visit to Station F, the world’s largest startup incubator. Registration is open until August 15.

- CoffeeWithBranch 2.0: Branch is Opening Its Doors to Tech Talent: We are back for round two! On August 27th in Lagos, discover the technologies powering Branch’s success in emerging markets, connect with our leaders, network with our team, and interview for open tech roles on the spot. This in-person event’s location will be shared with registered attendees. Register today.

- The Tech & AI International Expo 2025 will take place in Zanzibar on August 22–23, bringing together over 1,000 leaders from 30+ countries. Headlining the event is Ambassador Marie-Antoinette Rose Quatre, CEO of the African Peer Review Mechanism, who will launch Africa’s first Continental e-Governance Platform. The Expo will also unveil a $50 million fund for AI, fintech, green energy, and smart infrastructure startups, alongside panels exploring digital sovereignty, policy innovation, and the future of African tech. Register here to attend.

- This November, Lagos will host Africa’s first-ever large-scale celebration of customer loyalty—the Bvndle Rewards Festival. Happening November 14–15, 2025, the two-day event by Bvndle Loyalty Limited will welcome 5,000+ attendees and 70+ speakers for immersive brand activations, live performances, thought leadership, and customer appreciation awards—all aimed at redefining loyalty beyond transactions. Join the waitlist.

- Toronto, Founders Connect is coming to you! :flag-ca: Founders Connect is hosting a one-day summit for Black and African founders, professionals, creators, and operators, filled with real stories, practical lessons, and powerful connections, on Saturday, August 16, 2025, at 2:00 PM, at One Eleven, Toronto. Expect raw conversations, expert-led sessions, and a room full of ambitious builders. Register here.

Written by: Emmanuel Nwosu, Frank Eleanya, and Faith Omoniyi

Edited by: Faith Omoniyi

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/KXOTSG9

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon