Happy mid-week!

Kenya has set a timeline for the publication of its national AI strategy, targeting May 2025. This move comes in response to the increasing adoption of AI technologies among Kenyans and follows earlier efforts to combat the spread of AI-driven misinformation in the country. It will join several other African countries—including Algeria, Senegal, and Egypt—that have defined regulatory frameworks for AI.

Streaming

Canal+ extends deadline for MultiChoice takeover

Canal+, the French broadcasting giant, has extended the deadline to finalise its takeover of South Africa’s MultiChoice from April 8, 2025, to October 8, 2025. This extension allows more time to set up a licencing company (LicenceCo) that complies with South Africa’s foreign ownership laws, a key requirement for the deal’s approval.

Canal+ has had its paws on South Africa’s MultiChoice for so long, viewing the pay-TV group as its most effective gateway into Africa, thanks to its operations across multiple countries. MultiChoice first caught Canal+’s attention in 2020 when it acquired a 6.5% stake in the pay-TV provider. Over the years, this stake steadily increased, reaching 41.6% by April 2024 and triggering a mandatory takeover offer under South African law. In response, Canal+ offered to buy the remaining shares at R125 ($6.74) per share.

The transaction was initially expected to close by April 2025, but regulatory hurdles, particularly South Africa’s broadcasting ownership laws, slowed progress. The process was further complicated by Canal+’s separation from its former parent company, Vivendi, in December 2024, which led to its independent listing on the London Stock Exchange. Despite these challenges, the extension confirms Canal+’s commitment to acquiring MultiChoice under its new corporate structure.

To comply with South African regulations, a new entity, LicenceCo, will be established to hold the country’s pay-TV licence and manage DStv subscribers. It will be controlled by South African stakeholders, including Phuthuma Nathi, Identity Partners, Itai Consortium, Afrifund Consortium, and a Workers’ Trust. Meanwhile, MultiChoice Group will shift from being a broadcaster to functioning solely as a video content supplier.

Acquiring MultiChoice is a strategic move for Canal+, which aims to expand its influence in Africa’s fast-growing media market. MultiChoice is the largest pay-TV provider on the continent; an acquisition will strengthen Canal+’s position in both traditional and streaming services, helping it compete with global streaming giants with a target of 100 million subscribers.

The full licencing and broadcasting takeover could bring increased investment in local content, improved streaming options, and potentially more competitive pricing. However, regulatory scrutiny and local content requirements will shape how Canal+ operates in the region.

Are you an Afincran?

If you’re building solutions for Africa, you already are. Join Fincra’s mission to empower Africa through collaborative innovation. Together, we’re building the rails for an integrated Africa. Join the Afincran movement—let’s drive change!

Cryptocurrency

Why taxing cryptocurrency in Kenya might be a long road

Kenya’s push to tax cryptocurrency transactions through a 3% Digital Asset Tax (DAT) has drawn more criticism from industry stakeholders. They argue that the challenges of taxing crypto extend beyond just setting a percentage.

The approach Kenya is taking appears rushed and risks alienating key industry players. The Virtual Asset Service Providers (VASP) Bill, 2025, which seeks to regulate the crypto sector, was released in January 2024, but stakeholders were initially given a short window to review and provide feedback. After concerns were raised, the Blockchain Association of Kenya (BAK) extended the consultation period until early February. Even with the extension, many in the industry argue that meaningful input requires more time, especially for a sector as complex as crypto.

Another key issue is enforcement. Unlike traditional financial institutions, crypto operates in decentralised networks with peer-to-peer (P2P) trading at its core. Kenya has proposed a real-time crypto tax monitoring system through the Kenya Revenue Authority (KRA) to track transactions, but its effectiveness remains questionable.

Many traders rely on informal P2P networks and mobile money services, making oversight difficult. While the government has shown signs of cooperating with large centralised P2P networks operating in Kenya, there’s still the argument of incentives for these foreign players—which is not there yet given Kenya is a relatively smaller market for crypto transactions. If enforcement mechanisms are weak, traders may shift to offshore platforms or decentralised exchanges to avoid taxation.

Additionally, the 3% tax is significantly higher than global standards, potentially discouraging innovation and driving local crypto startups out of the country. KotaniPay, which went for a South African crypto licencing in 2024 is one clear example. Indonesia, the only other country with a similar levy, charges between 0.1% and 0.2%—a fraction of what Kenya proposes. If the costs of compliance outweigh the benefits, companies may choose to operate elsewhere, undermining Kenya’s goal of becoming a fintech leader.

Regulating and taxing cryptocurrency requires a nuanced approach. Kenya must balance revenue collection with policies that support industry growth. Without clear guidelines, proper consultation, and practical enforcement mechanisms, the road to effective crypto taxation will be long and uncertain for Kenya.

YouA startup’s guide to understanding data privacy

Discover tactical tips for African startups on building a strong foundation for data privacy and protection. Learn more→

Fintech

M-PESA’s fix for a costly problem

Erroneous transactions have long been a headache for M-PESA users, and an expensive one for Safaricom. But a simple tweak to Hakikisha, its transaction confirmation feature, has slashed daily reversal requests from 12,000 to 4,000.

It’s easier for M-PESA customers to authenticate a transaction with a “Yes” or “No” action instead of the previous opt-out system, which required dialing a number within 15 seconds to cancel a payment. It was a clunky process that often backfired.

“The call to action was not very clear,” said Anita Kaunga, M-PESA’s Product Manager for Consumer Payments.

The impact extends beyond M-PESA. Kenyan banks and rival mobile money services like Airtel Money have adopted similar verification steps to curb misdirected payments, a particular pain point for banks, where reversals can take a week or more.

Not everyone is thrilled, though. Some users exploit Hakikisha to look up names without completing transactions. In response, M-PESA has capped verification attempts at five per day, disabling the feature for anyone exceeding the limit.

M-PESA, which turns 18 on March 25, remains Safaricom’s biggest money-maker, raking in KES 77.22 billion ($597 million) in revenue in the half-year ending September 2024. With fewer botched transactions and a smoother user experience, it’s doubling down on its dominance in Kenya’s digital payments space.

The Moonshot Deal Book is Coming!

Introducing the Moonshot Deal Book—our exclusive collection of the most promising and investable startups in Africa. If you’re an investor looking for the most exciting investment opportunities on the continent, sign up to join the waitlist and you’ll be among the first to access this investor-focused resource once it is live. Join the waitlist.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $86,920 |

+ 4.00% |

– 6.85% |

|

| $2,172 |

+ 4.09% |

– 12.27% |

|

| $211.21 |

+ 21.45% |

– 5.04% |

|

| $141.78 |

+ 3.61% |

– 26.09% |

* Data as of 06.00 AM WAT, March 5, 2025.

Opportunities

- In celebration of International Women’s Day 2025, Spurt! is extending an invitation to all fund managers and fund employees keen to augment the flow of capital to women-led businesses. The event, organised by Spurt! in partnership with the UK-Nigeria Tech Hub, is convening operators and investors for the launch of a working group that delivers tangible outcomes on the flow of capital. RSVP here by March 7.

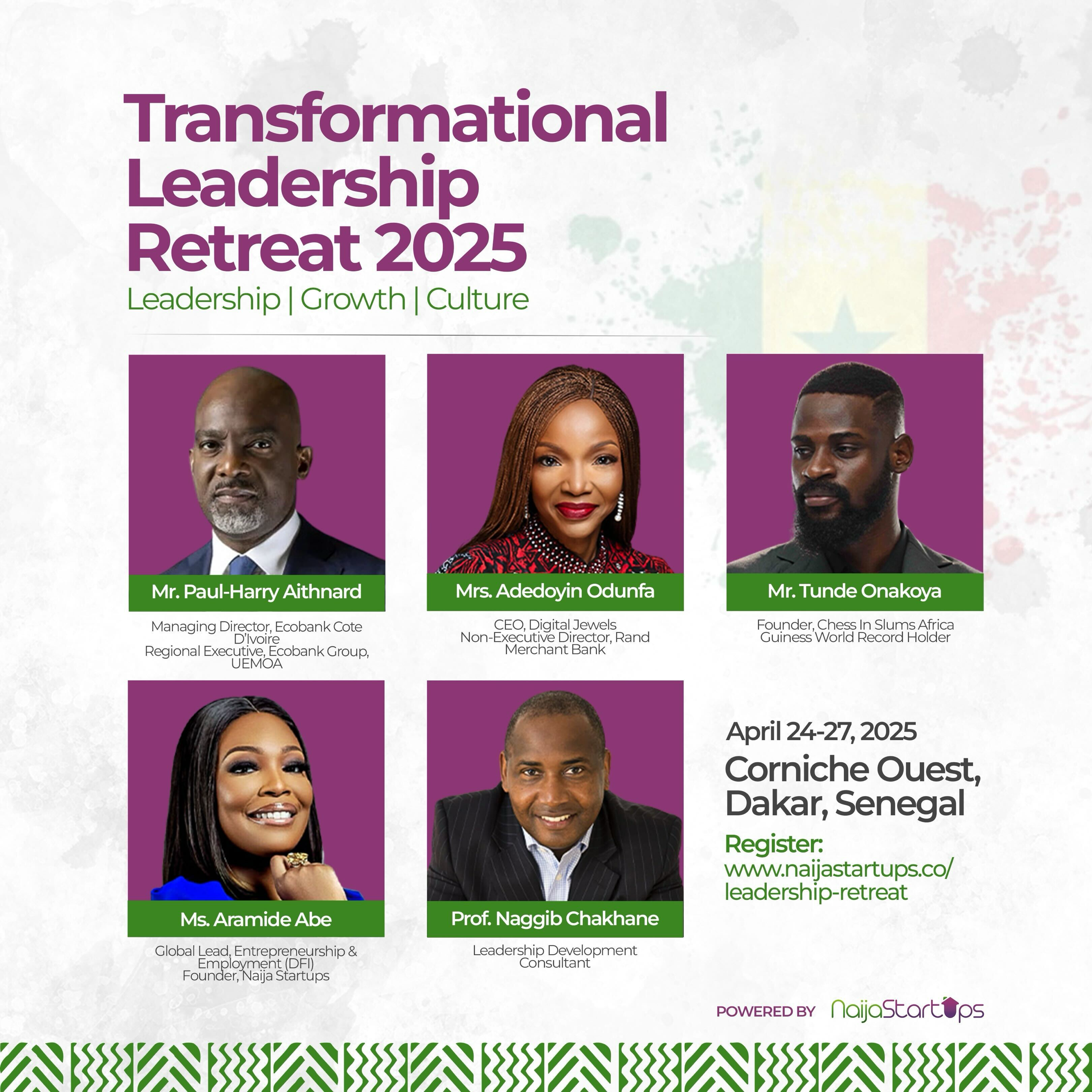

- Naija Startups, the influential business leader network connecting Africans and non-Africans alike, founded by Pan-Africanist Aramide Abe, has announced its Transformational Leadership Retreat, scheduled for April 24-27, 2025. This exclusive gathering aims to unite visionary African entrepreneurs and executives for an immersive experience of strategic networking, focused workshop sessions, and cultural immersion—all against the vibrant backdrop of Senegal’s bustling capital. It will feature guest speakers, Tunde Onakoya, Paul-Henry Aithnard, Adedoyin Odunfa, and Naggib Chakhane.Register by April 24, 2025.

- Lagos Innovates (LSETF) is offering workspace vouchers to startups in Lagos to ease rising operational costs. Startups can access subsidised coworking spaces with reliable internet, power, and a supportive entrepreneurial community. The program is open to Lagos-based startups looking to reduce overheads and focus on growth. Apply now.

Written by: Emmanuel Nwosu & Faith Omoniyi

Edited by: Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/sLOYKi7

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon