TGIF

Help us shape the future of African venture capital.

If you’re a venture capitalist investing in Africa, take our short survey to share your insights on investment priorities, challenges, and predictions for 2025.

Your input will contribute to a comprehensive analysis of the trends shaping Africa’s venture capital landscape. Take the survey now.

Startups

How Marasoft’s CEO paid employees with suspected fraudulent funds

Imagine working tirelessly for two months without pay, only to watch your colleagues lose patience and halt work due to delayed salaries. Then, just as you think the ordeal might end, your boss finally sends the owed salaries—but the funds appear to come from suspected fraudulent transactions.

This chaotic scenario became a reality for over 40 employees of Marasoft Pay, a Nigerian fintech startup founded by Emmanuel Marakwe-Ogu. The company, which operated without institutional funding, processed payments online for businesses and individuals in Kenya and Nigeria.

Since Marasoft does not hold local licenses in Kenya, it relied on a Flutterwave wallet to process transactions—a common workaround for smaller startups seeking access to new markets and regulatory protection. However, on October 16, a glitch allowed a Marasoft account linked to Marakwe-Ogu’s phone and bank verification numbers (BVN) to withdraw funds exceeding the wallet’s balance.

In a WhatsApp group, Marakwe-Ogu acknowledged controlling the account after employees questioned why their salaries were paid from an unfamiliar source rather than the company’s human resources account. That payment became the catalyst for what several employees describe as one of the most turbulent periods of their lives.

Within weeks, resignations poured in as staff abandoned their posts. Efforts to maintain a unified stance crumbled when Marakwe-Ogu removed them from the company’s WhatsApp group. Many former employees remain locked out of their accounts and continue to grapple with the fallout.

Despite everything, some affected Marasoft employees have returned to work for the startup.

Collect payments Fincra anytime anywhere

Are you dealing with the complexities of collecting payments in NGN, GHS or KES? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. Get started now.

Funding

Visa invests in Moniepoint

What is better than funding? More funding.

Three months after Moniepoint raised its $110 million Series C funding to become Africa’s latest unicorn, the Nigerian fintech has a new investor: Visa.

The global payments giant made a “strategic investment” in Moniepoint, which has built a successful business offering banking services to SMEs and individuals. That investment is around $10 million, according to TechCrunch.

For Visa, this investment continues its signature move of strategically investing in promising African startups to expand its payment footprint. It made similar bets on other home-grown fintechs including Interswitch, Flutterwave, and Paystack.

With the new funding, Moniepoint plans to focus on advancing contactless payments, widely seen as the next golden egg in the payments ecosystem.

Moniepoint’s entry would mean more competition in the contactless payments space. Offering solutions from smartphone-based systems to software POS offerings, startups like CashAfrica, Nearpays, and Touch and Pay have entered the market. However, infrastructural challenges and other factors are slowing adoption rates.

Moniepoint’s advantage lies in owning its proprietary technology for both cards and POS machines. This vertically integrated approach, combined with Visa’s expertise, could enable the company to scale quickly in the contactless payments market. With its position as one of the top three POS providers in Nigeria, Moniepoint also has a strong customer base to drive adoption.

Beyond Nigeria, Moniepoint may be preparing to build its own contactless payments infrastructure to fuel expansion into other markets. The company has been in discussions to acquire Kenyan fintech Kopo Kopo. Entering Kenya with a robust contactless payments infrastructure could position Moniepoint as a formidable competitor in the region, where the demand for advanced payment systems is growing faster than in Nigeria.

As Moniepoint aggressively builds out its payments infrastructure, the fintech seems poised to establish itself as a leader in the contactless payments space. Still, it will face stiff competition from rival PalmPay, the fintech arm of popular OEM company Transsion, which also has ambitions in this fast-evolving market.

What’s it like to work as an engineer at Paystack?

Paystack’s engineering team builds simple, powerful tools to connect African businesses to customers. Learn more →

TC Insights

Funding Tracker

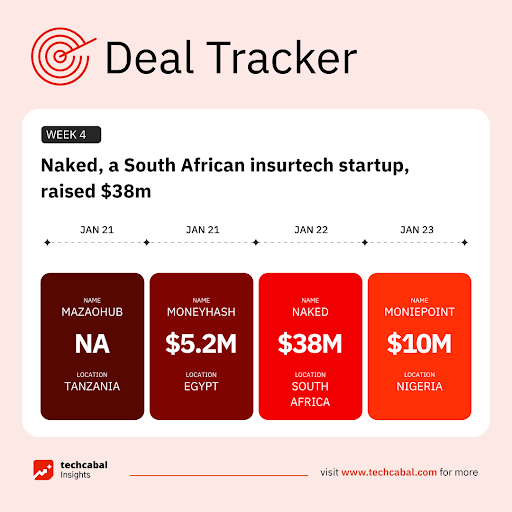

This week, South African insurtech startup Naked secured $38 million in a Series B extension funding round, marking the largest investment in Africa’s insurtech sector. The round was led by global impact investor BlueOrchard, with participation from existing backers Hollard, Yellowwoods, the IFC, and DEG. (January 22)

Here are other deals for the week:

- Nigerian fintech company Moniepoint secured $10 million from Visa, bringing its Series C raise to more than $120 million. (January 23)

- Egyptian fintech MoneyHash raised $5.2 million in a pre-Series A funding round. Flourish Ventures led the round, with participation fromSaudi Vision Ventures, Arab Bank’s Xelerate Fund, and Emurgo Kepple Ventures. Angel investor Jason Gardner, founder and former CEO of Marqeta, also joined the round alongside existing investors such as COTU, RZM Investment, and Tom Preston-Werner. (January 21)

- MazaoHub Agclimate Ltd, a Tanzanian agri-tech startup, secured undisclosed funding from the Livelihood Impact Fund. (January 21)

- CommunityWolf, a South African AI startup, received undisclosed early-stage funding from The Baobab Network. (January 22)

- Ugandan fintech Flow Global secured an undisclosed equity investment from Inua Capital (January 22)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, read our predictions on what to expect in African tech in 2025. Click this link to read it.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $103,920 |

+ 2.20% |

+ 5.91% |

|

| $3,301 |

+ 2.83% |

– 5.30% |

|

|

$3.12 |

– 0.12% |

+ 35.82% |

|

| $251.44 |

+ 2.14% |

+ 25.80% |

* Data as of 05:35 AM WAT, January 24, 2025.

Events

- GITEX AFRICA 3rd edition is NOW OPEN for registration. Africa’s largest tech and start-up event will be held from 14-16 April 2025 in Marrakech, Morocco. Attend to see the leading brands in tech, and the most innovative startups, and network with tech leaders, investors, speakers and government delegations from across Africa and across the globe. Register here.

- The Lagos Tech Fest is set to hold its fifth edition from February 19–20, 2025 at the Landmark Event Center, VI, Lagos. Lagos Tech Fest gathers startups, innovators, investors, and government representatives to shape Nigeria’s tech future through conferences, exhibitions, networking, and driving ecosystem investments. Get a ticket here.

Written by:Stephen Agwaibor, Emmanuel Nwosu & Faith Omoniyi

Edited by: Timi Odueso & Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/CeLFBRE

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon