Good morning

Here’s your reminder to add TC Daily to your Primary/Main folder so you don’t miss any important updates.

Telecoms

MTN Nigeria’s share price jumps by 10% after news of tariff hike

Investors holding MTN Nigeria (MTNN) shares had reasons to smile yesterday after regulators approved the 50% tariff hike on Monday. The markets reacted positively to the news, pushing MTN Nigeria’s shares up almost 10%. MTNN shares traded at ₦256.30 ($0.16) at the close of market on Tuesday—its highest since March 2024.

While MTN Nigeria traded higher, shares of Airtel Africa, another publicly listed telco that has previously voiced opinions on the tariff hike, remained unchanged. This is likely because Airtel Africa’s listing covers its entire African business portfolio. So, while the news in Nigeria is positive, it is a small cog of the 14 markets where the telco operates.

Telcos like MTN Nigeria and Airtel have been bleeding billions of naira in FX losses owing to the currency devaluation in major markets.

During its Q3 2024 results announcement on October 30, 2024, MTN Nigeria reported a nine-month ₦514.9 billion ($331 million) FX loss. Following this, its share price stayed unchanged. However, six days later, the price fell from ₦175 to ₦169, marking a 3.4% drop. This reflected investor concerns over the company’s ability to weather Nigeria’s tough economic conditions.

With the tariff hike, MTN Nigeria is expected to turn a profit—or at least hedge its FX losses—by Q1 2025. Investors are confident that the expected revenue boost will stabilise the company’s finances, improve profitability, and drive growth in the coming months.

Collect payments Fincra anytime anywhere

Are you dealing with the complexities of collecting payments in NGN, GHS or KES? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. Get started now.

Telecoms

Globacom’s Ahmad Farroukh resigned as CEO after one month

Ahmad Farroukh, who assumed Globacom’s CEO role in October 2024, stepped down in November after just one month, marking one of the briefest leadership tenures the Nigerian telecoms sector has seen.

Farroukh’s resignation is more than a headline—it’s a sign of the telco’s struggles.

Here’s how Ayoola Oke, a former Special Adviser to the former Executive Vice-Chairman of NCC, Ernest Ndukwe, described the news.

“A CEO leaving in one month is unprecedented in the industry. The NCC can investigate the reason for his exit. The commission can seek an explanation from the CEO, who is not obligated to respond, or from the company because this is about corporate governance, which the NCC Act covers.”

While Globacom has stayed silent, insiders point to the company’s centralised management style as a key reason for Farroukh’s quick exit.

Led by its Nigerian billionaire founder Mike Adenuga, Globacom has long relied on a top-down approach to decision-making. Before Farroukh, Adenuga led the telco as CEO from its founding in 2003.

The steady decline of telco over the years brought the issues the company faced to the public’s attention.

Its market share plummeted to 12% following regulatory penalties for improperly registered SIMs. It further lost 40 million subscribers after the Nigerian Communications Commission (NCC) reviewed its subscriber data. Add to that a reputation hit from a 2023 data breach that exposed millions of customers, and you have a company in crisis mode.

Bringing in Farroukh was supposed to be a statement that the telco wanted to turn things around. However, the timing of Farroukh’s resignation raises tough questions. Can Globacom adapt to regulatory pressures and regain its edge in a fiercely competitive market? Or will its entrenched governance style make it harder to retain top talent and rebuild?

With Farroukh’s exit, seeing Globacom’s next moves will be interesting—whether it hires a new CEO or Adenuga reclaims the reins. A company that once defined Nigeria’s telecom success now faces a stark choice: evolve or risk falling further behind.

Cryptocurrency

Kenya wants crypto firms to establish physical offices, have vetted CEOs

Kenya has updated its newly introduced Virtual Asset Service Providers Bill, 2025, as part of its efforts to regulate the crypto sector. The bill now requires crypto firms to establish physical offices in Kenya, seek licences, and have their executives vetted by regulators.

Last week, Kenya also demanded that social media companies establish a physical presence in the country. These actions show that the government wants to strengthen its control over global businesses by ensuring they are directly accountable to local authorities, making it easier to enforce regulations and monitor their operations.

However, the crypto bill raises some concerns. Many crypto firms operate remotely without physical offices. Opening physical offices in the country would require them to seek licences and other operating approvals from the regulator, which some crypto companies—especially foreign ones—may view as excessive, given their operations in other markets.

Yet, if the market is important enough, they’ll set up offices. Foreign crypto companies like Luno, for example, claim to have a physical presence in Nigeria, but online records do not verify this—signaling that offshore companies have largely operated without the need for physical locations, relying instead on the ruse of remote collaboration. However, with Kenya pushing for this rule, it could set a precedent for how African governments engage with foreign businesses.

Kenya has faced criticism over its slow implementation of a regulatory framework for crypto. That sluggishness led to Kotanipay, its homegrown crypto exchange, obtaining a crypto licence first in South Africa before its own country. However, Kenya is now making noticeable progress in stepping up efforts to bring the crypto sector under its watch.

The country’s move to regulate crypto is part of a larger trend across Africa, where governments are attempting to strike a balance between encouraging innovative technology and protecting consumers.

Or, in Kenya’s case, it may just be acting under incentives to introduce crypto into its formal economy to allow its taxman to collect taxes from crypto companies.

Whether this strategy will succeed in the long term remains uncertain, but crypto is starting to look a lot less like fringe technology for many African countries.

What’s it like to work as an engineer at Paystack?

Paystack’s engineering team builds simple, powerful tools to connect African businesses to customers. Learn more →

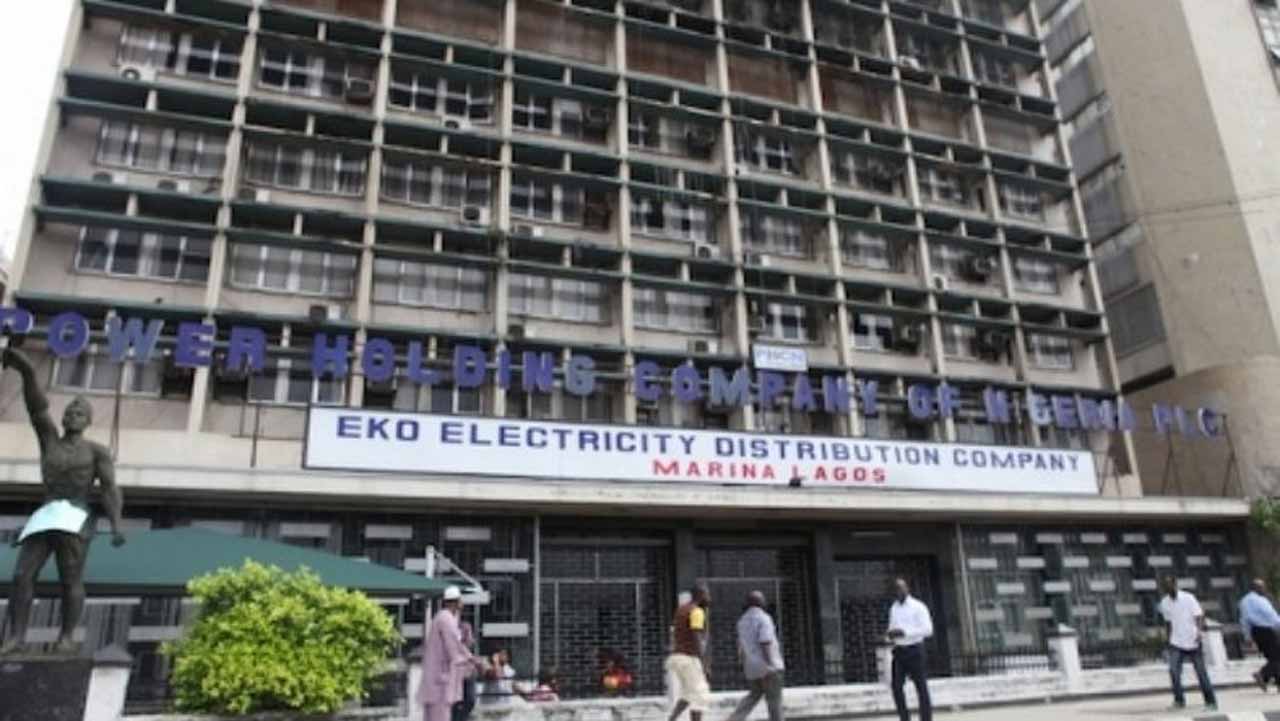

M&As

Transgrid Enerco acquires Eko DisCo

Earlier this month, West Power and Gas Ltd (WPG) said it was selling its stake in Nigeria’s second-largest distribution company, Eko Electricity Distribution Company (Eko DisCo).

Yesterday, the company found a buyer in Transgrid Enerco Limited.

Transgrid Enerco Limited announced that it had acquired 60% of WPG’s stake in the company, giving it ownership of Eko Electricity Distribution Company. While the financial details of the deal were not disclosed, the deal which is expected to be completed in April 2025 is estimated to be worth around $200 million.

The acquisition offers several benefits to the different stakeholders of the Transgrid Enerco group which is made up of North-South Power (NSP), owners of Shiroro Dam; Stanbic Infrastructure Fund, Nigeria’s largest infrastructure fund and Axxela, a large gas producer.

Nigeria’s recent shift towards bilateral contracts between distribution and generation companies has created new incentives for power generation firms like North-South Power (NSP) to invest in DisCos. For instance, Transcorp Power, owners of the Ughelli Power Plant, holds a substantial stake in Abuja DisCo.

The deal allows NSP to gain direct control over Eko DisCo’s operations. By taking control of Eko DisCo’s operations, NSP will gain better insight into the company’s cash flow and financial performance, enabling it to make more informed investment decisions in the power sector.

For gas companies like Axxela which rely on power-generating companies for income, the acquisition helps the company tap into the distribution end of the market, giving it direct access to cash flow.

The deal provides Stanbic Infrastructure Fund, Nigeria’s largest private equity fund focused on infrastructure, with a rare opportunity to invest in the power sector. This aligns with the ₦100 billion ($64 million) fund’s goal of targeting assets with strong cash flow potential to meet its commitments to investors.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $105,756 |

+ 3.79% |

+ 10.48% |

|

| $3,331 |

+ 2.81% |

+ 0.48% |

|

|

$3.18 |

+ 3.06% |

+ 44.74% |

|

| $257.07 |

+ 8.43% |

+ 39.67% |

* Data as of 06:25 AM WAT, January 22, 2025.

Events

- The Lagos Tech Fest is set to hold its fifth edition from February 19–20, 2025 at the Landmark Event Center, VI, Lagos. Lagos Tech Fest gathers startups, innovators, investors, and government representatives to shape Nigeria’s tech future through conferences, exhibitions, networking, and driving ecosystem investments. Get a ticket here.

Written by:Emmanuel Nwosu & Faith Omoniyi

Edited by: Timi Odueso & Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/AP37XNt

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon