Good morning!

If you’re looking for an event to close out your year, our friends at Founder Institute Lagos are hosting Unwind 2.0 on the 13th of December.

The theme of the event is “How We Built It” and will feature firsthand insights from founders who’ve turned challenges into opportunities. There’s also the opportunity to network with investors and other ecosystem players.

So if you’re a founder, an investor, or a startup ecosystem enthusiast in Lagos, register for Unwind 2.0.

Cybersecurity

Only 29% of South African organisations will increase cybersecurity budget in 2025

What is the answer to a wave of cyberattacks that affected South Africa’s biggest institutions in 2024?

Apparently, not a bigger cybersecurity budget. In the last three years, South African organisations—including big corporations and government parastatals—have lost up to $20 million to damning cyberattacks and data breaches.

This year, the country was ranked as one of the most-affected countries in Africa, dealing with more than 1,876 recorded cases in Q3 2024 alone.

Government arms like the Companies and Intellectual Property Commission (CIPC) and the National Health Laboratory Services suffered breaches.

Despite these headline-grabbing cyberattacks, only 29% of South African organisations plan to increase their cybersecurity budget by 2025, according to consulting firm PwC.

The disconnect is striking. Cybercriminals are sharpening their hunting instincts and shooting faster than these organisations can fly. Some of them are forming hacktivist and syndicate groups to attack and share companies’ data among themselves or sell the information for cheap.

Large South African organisations that are getting minimal budget lifts could mean one of two things: they have either implemented top cybersecurity policies and only consolidation remains, which likely explains the minimal spend. Or, they are de-prioritising a channel that was a leaky pipe for them in 2024.

If the latter is the case, then the rhetoric here is whether South Africa’s biggest organisations are irrationally optimistic about the threats.

Read About Moniepoint’s Impact on Pharmacies

Do you remember what you bought the last time you visited a pharmacy? Data from Moniepoint’s pharmacy case study reveals it was likely a painkiller. Click here to discover how Moniepoint is enabling access to healthcare through payments and funding for community pharmacies.

Telecoms

Investments in Nigeria telecoms market drop by 87% in Q3 2024

Like Nigeria’s tech ecosystem, the telecommunications sector has seen a decline in foreign investments.

Data from Nigeria’s Bureau of Statistics (NBS) shows there was an 87% decline in foreign investments in Q3 2024. The sector received about $14.4 million, a steep decline from the $113.42 million recorded in the previous quarter.

According to the data from the NBS, the telecom sector’s capital inflow plummeted 77% year-on-year in Q3 2024, shrinking from $64.05 million in 2023 to just $14.73 million.

The decline in investment is not particularly surprising given the macroeconomic challenges in Nigeria. Telcos across the country have borne the brunt of Nigeria’s currency devaluation. MTN Nigeria, the country’s largest telco and historically a guaranteed profit maker, reported a loss after tax of ₦519 billion ($834 million) for the first half of 2024, mostly due to FX devaluation. Airtel too, the country’s second-largest telco, in February, reported a 99% decline in profits, mainly due to currency devaluation in Nigeria and its other markets.

These losses coupled with other factors like shrinking demands from customers—due to low consuming power—erratic power supply and multiple taxations have forced companies to rethink their investment strategy in the country. Airtel, MTN Nigeria, and IHS Towers are considering reducing their investments in Nigeria.

Get Fincra’s Embedded Finance and BaaS Report 2024 for FREE

Fincra in collaboration with The Paypers have released the Embedded Finance and Banking-as-a-Service Report 2024. This report examines the key challenges and innovative solutions defining the future of seamless cross-border payments and remittances across the continent, among other topics, with key experts.

Funding

Nigeria to offer $1.2 million in loans to MSMEs

The Nigerian government plans to introduce a ₦198 billion ($1.2 million) syndicated loan fund to boost Micro, Small, and Medium Enterprises (MSMEs) in the country. The goal is to improve access to affordable credit for MSMEs that are often overlooked for venture funding.

Starting in Q1 2025, the initiative will offer loans—up to ₦400,000 ($289)—with a 9% interest rate, a five-year tenure, and a one-year moratorium, enabling businesses to grow and innovate sustainably.

This is a relief for MSMEs which, unlike tech startups, have limited access to funding and capital to expand their businesses.

MSMEs have loans and grants. Tech startups have venture capital. The rationale is not hard to see. VCs want outsized returns and there is often pressure to pick wide-margin winners. High-growth tech startups, unlike MSMEs, characterise these ventures that can hit a wider market—as a result of their underlying tech-enabled services—and scale quickly.

VCs have also voiced their preference for tech companies due to their globalisation, which again, exposes them to a wide market that increases their chances of attracting high-value customers that move the business.

On the other hand, MSMEs are the mundane, usually “non-tech” ventures that lack that same global application. They are not usually VC darlings because they cannot sell to the entire country at the same time.

MSMEs may not be the hyper-scale, exponential growth startups that VCs love, but they contribute significantly to Nigeria’s economy. Their positioning and closeness to low-end users makes it easy for them to sell much-needed, everyday consumer goods.

But MSMEs have typically lacked access to credit and loan facilities. Instead, tech startups and microfinance banks have since stepped up to close this funding gap for MSMEs.

With the government’s backing, this loan fund for MSMEs could position the informal sector to become a driver of economic growth, closing the funding gap in the often-overlooked area.

Introducing Paystack transfers in Kenya

Paystack merchants in Kenya can now send single and bulk transfers to any Kenyan bank or MPESA account (including customer wallets, Paybills, and Tills) Learn more →

Regulation

US upholds TikTok ban

After years of an on-again, off-again relationship, Tiktok, the popular social media app owned by China’s ByteDance, and the US could part ways in 2025. On December 6, TikTok lost a federal court appeal after a passed legislation stated it must either resell its app to a non-Chinese, government-approved buyer in the US, or face a ban.

If you’re not aware of the fuss, the US Congress has long accused TikTok of siding with the “Chinese state” due to its ByteDance ownership and affiliation with China. US president-elect Donald Trump unsuccessfully tried to ban the app in his first tenure.

The US has also been wary of how TikTok collects and stores user data, fearing that it could use it to influence over 170 million Americans. A major concern is that TikTok stores data of some American users in China, where it can be accessed by the Chinese government.

This escalated when former ByteDance employees confirmed they could access US users’ accounts. Despite TikTok CEO Shou Zi Chew testifying in Congress in March 2023, and assuring that data safeguards were in place, these explanations failed to ease lawmakers’ fears.

TikTok has countered some of the allegations, saying that it is incorporated in Delaware and California which subjects it to the US laws. It has also denied claims that a government entity owns a controlling share in ByteDance.

But the short-form video company’s global reputation isn’t helping: the app is banned in China, India, and 23 other countries over similar concerns. If the US ban succeeds, that number could go up, inclduing in Africa.

African leaders have, fopr less cogent reasons, blocked social platforms before. If TikTok falls out of favour in the US, African countries that have developed concerns over the misinformation in the app, could follow suit, leaving businesses and creators dependent on the app scrambling for alternatives.

TikTok has one last plan up its sleeves. It will appeal to the Supreme Court to try and overturn a decision that could have global repercussions for its business.

Get Up to 5% Discount on Your Monthly Subscription

Pay for Google Workspace in Naira with Mercurie and save up to 5% monthly! Enjoy seamless payments, avoid currency hassles, and keep your business running smoothly. Simplify your subscription today. Click here now to get started!

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $98,186 |

– 5.07% |

+ 31.64% |

|

| $3,888 |

+ 0.54% |

+ 49.85% |

|

| $2.39 |

+ 3.52% |

+ 350.18% |

|

| $241.62 |

+ 2.10% |

+ 29.71% |

* Data as of 06:15 AM WAT, December 6, 2024.

Job Openings

- PressOne Africa – Growth and Sales Operations Manager – Lagos, Nigeria

- Condia – Sales and Partnership Associate – Remote (Nigeria)

- Moniepoint – Growth Product Partner – Lagos, Nigeria

- 54 Collective (Radease) – Growth Manager – Hybrid (Lagos, Nigeria)

- Renmoney – Chief of Staff – Lagos, Nigeria

- Interswitch Group – Data Engineer, Mobile App Developer – Hybrid (Lagos, Nigeria)

- Fairmoney – Data Engineer – Remote (Lagos, Nigeria)

- Duplo – Senior Product Manager, SaaS, Risk & Compliance Manager – Hybrid (Lagos, Nigeria)

- Reliance Health – Content Strategist – Remote (Lagos, Nigeria)

- Darey.io – Quality Assurance Specialist – Lagos, Nigeria

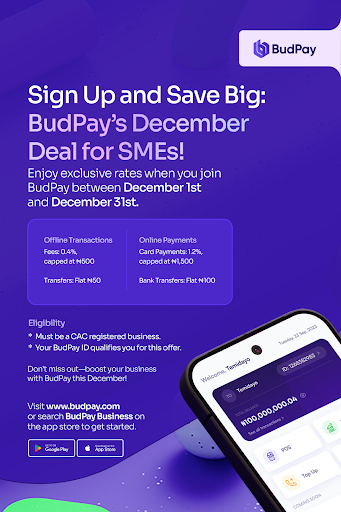

Save Big On BudPay’s December Deals for SMEs

Payments are crucial for every business. Whether you’re just starting or have been operating for a few years, BudPay has an exclusive opportunity for you! From December 1st to 31st, enjoy exclusive rates. Sign up for BudPay’s December Deal for SMEs! Visit budpay.com to get started.

Written by: Faith Omoniyi & Emmanuel Nwosu

Edited by: Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/WVBzKXy

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon