Good morning!

As far as contactless payments go, rings may be about the coolest thing to put an NFC chip in.

NFC-enabled rings are as useful as they are flashy. With them, you don’t have to bend your wrist awkwardly to tap and pay, unlike with wearables like a smartwatch.

Yet, reviews say NFC rings “don’t quite work as they should,” but you should be good on your third try—just carry your card as a backup.

What other cool accessories that double as devices come to mind?

Banking

KCB customers overdrew accounts by $7.7 million during glitch

Technical glitches at KCB Group, Kenya’s largest bank, allowed customers to withdraw more than their actual balances, leading to a loss of about $7.7 million (KES 1 billion) between October 11 and 31.

The issue arose during critical data migration from on-premise to a colocation centre hosted by iColo, a tier 3 data centre.

A subsequent attempt to integrate cloud databases resulted in a synchronisation error. This led to real-time balance updates failing, which then allowed customers, mainly those with KCB-M-PESA target savings accounts, to withdraw up to triple their saved amount.

The bank has since restricted the accounts of overdrawn customers and told them to regularise their accounts so they can recoup the funds.

An investigation by TechCabal has revealed multiple service disruptions and system outages over the last few weeks, a pointer that the lender is struggling to patch its systems as it modernises its IT infrastructure.

Lapses in technical operations have become a concerning issue in the Kenyan banking sector over the last few years. Ecobank Kenya lost “millions of dollars” between 2020 and 2022 due to vulnerabilities in its card operations team, which left the bank exposed to potential fraud by merchants and staff. Similarly, Equity Bank was targeted in a debit card fraud case where $2.1 million was stolen.

Read Moniepoint’s Case Study on Funding Women

After losing their mother, Azeezat and her siblings struggled to keep Olaiya Foods afloat. Now, with Moniepoint, they’re transforming Nigeria’s local buka scene. Click here for a deep dive into how Moniepoint is helping her and other women entrepreneurs overcome their funding challenges.

Fintech

MTN’s MoMo PSB has applied for PSSP and PTSP licences

MTN Nigeria is going all in on fintech, swapping signal towers for something a bit more… moneyed. The telecom giant applied for two payments licences: the Payment Service Solutions Provider (PSSP) and Payment Terminal Service Provider (PTSP) licences.

With the PSSP licence, MTN will be able to process payments for merchants and users alike. Imagine them as the new digital wallet you didn’t know you’d need, smoothly zipping your money from A to B.

And if they secure the PTSP licence, they’ll have the green light to roll out POS terminals across the country—basically bringing cashless, card-swiping to every nook and cranny of Nigeria. Yet, MTN will have Moniepoint, OPay, and Palmpay to contend with in this segment.

This isn’t MTN’s first fintech rodeo either; MoMo is one of the leading mobile money operations in Nigeria with 5.5 million wallets to show for it.

And if all goes to plan—i.e., the CBN approves—these licences will make MTN a heavyweight in the financial services ring.

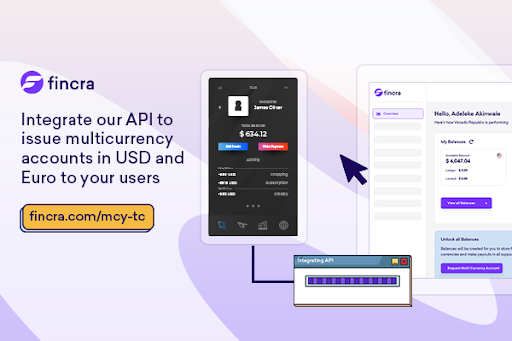

Issue USD and Euro accounts with Fincra

Whether you run an online marketplace, a remittance fintech, a payroll, a freelance platform or a cross-border payment app, Fincra’s multicurrency account API allows you to instantly create accounts in USD and EUR for customers without the stress of setting up a local account. Get started today.

Companies

MainOne founder and managing director Funke Opeke retires

In November 2024, tech trailblazer Funke Opeke is retiring as Managing Director for West Africa at MainOne, the connectivity giant she founded nearly two decades ago. Opeke will still be around in an advisory role, offering her expertise as MainOne completes its transformation under new owner Equinix.

Who’s filling her shoes? Wole Abu, the current CEO of Liquid Intelligent Technologies Nigeria, who’s already plotting the company’s next big moves in internet services and data centres. He resumed on November 1.

The company hosted an exclusive dinner party to welcome him to the MainOne family this Tuesday.

Equinix snagged MainOne for a cool $320 million in 2022, with plans to keep the MainOne brand alive under “Solutions by Equinix.” And they aren’t playing small—three shiny new data centres and a massive fibre expansion are in the works, set to make waves in Africa’s connectivity landscape. Equinix’s big leap into West Africa via MainOne has cemented its role as a heavyweight in the region’s tech ecosystem.

Opeke’s journey with MainOne has been game-changing. Back in the day, she led the charge to bring West Africa’s first private submarine cable ashore, setting the stage for a connectivity revolution. Today, MainOne stands tall as Nigeria’s go-to internet provider, trusted by top banks and telcos alike.

Introducing Paystack transfers in Kenya

Paystack merchants in Kenya can now send single and bulk transfers to any Kenyan bank or MPESA account (including customer wallets, Paybills, and Tills) Learn more →

Economy

Kenya’s tax collector begins monitoring mobile transactions

Kenya’s new tax compliance methods may bring back the antiquated methods of saving money under mattresses.

The country recently got fresh funding from the International Monetary Fund—a $606 million loan. One of the loan conditions was that Kenya must increase its tax revenue—Kenya is gunning for KES 20 trillion ($158.8 billion) in the next five years. The Kenya Revenue Authority (KRA) is using technology to up the country’s tax compliance strategy and make sure it hits this audacious goal.

In its brief to the IMF, the KRA disclosed one of Kenya’s leading telecommunication companies has already started sharing real-time data on mobile money transactions. It projects that by 2025 it will have integrated with every telecommunication company and be able to see data of reported income and actual spending patterns of taxpayers—information that can be used to drive data compliance.

The KRA says it is looking out for tax evaders, but reports say the move may drive residents to opt out of banks and keep their money in their houses or under their mattresses for cash spending away from the government’s oversight.

Kenya’s close monitoring of transactions traces back to October 2024 when it announced that it would integrate a real-time system to monitor and tax crypto transactions performed on asset exchanges as a strategy to increase revenue.

The KRA plans to collect KES 60 billion ($465 million) from digital coin traders by 2025.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $74,574.98 |

+ 9.14% |

+ 17.92% |

|

| $2,591.87 |

+ 6.79% |

+ 4.15% |

|

|

$0.006822 |

+ 6.16% |

+ 5.70% |

|

| $185.89 |

+ 16.16% |

+ 24.08% |

* Data as of 06:00 AM WAT, November 6, 2024.

Opportunities

- Nearly 200 startups, including those from Nigeria, are vying for top honours in the world’s largest pitch competition, Supernova Challenge 2.0. With a $200,000 prize pool and a top prize of $100,000, it’s a great opportunity for innovative ideas to gain recognition. Startups will be judged on their market opportunity, business model, and traction. Don’t miss this opportunity to pitch your idea to global investors and win equity-free funding. Apply now and take your startup to the next level!

- The Growth4Her Accelerator is open for women that want to take their businesses to the next level. Get expert mentoring, networking, and access to alternative financing options for your SMB. Apply for Cohort 4.

- Applications are open for the 2025 Acumen West Africa Fellows Programme, a fully funded opportunity for emerging leaders in West Africa. This six-month hybrid program supports individuals who are committed to solving poverty through entrepreneurship in sectors like education, agriculture, energy, and healthcare. Participants remain in their jobs while engaging in virtual and in-person learning experiences designed to build their leadership skills. Apply by November 25.

- Applications are open for the 2025 Google for Startups Growth Academy: AI for Cybersecurity, a three-month hybrid program for Seed to Series A startups using AI to tackle cybersecurity challenges. Selected startups will receive equity-free support, mentoring from Google experts, and tools to scale internationally. The program includes in-person kickoff and graduation sessions, along with continuous mentorship and technical consulting. Apply by December 3.

Get 60% off Google Workspace for a Year

Start on Google Workspace with a 60% discount on your monthly subscription and pay in Naira when you pay through Mercurie. Sign up to get started now.

Written by: Kenn Abuya, Frank Eleanya, and Adonijah Ndege

Edited by: Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/sidQzIR

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon