Good morning

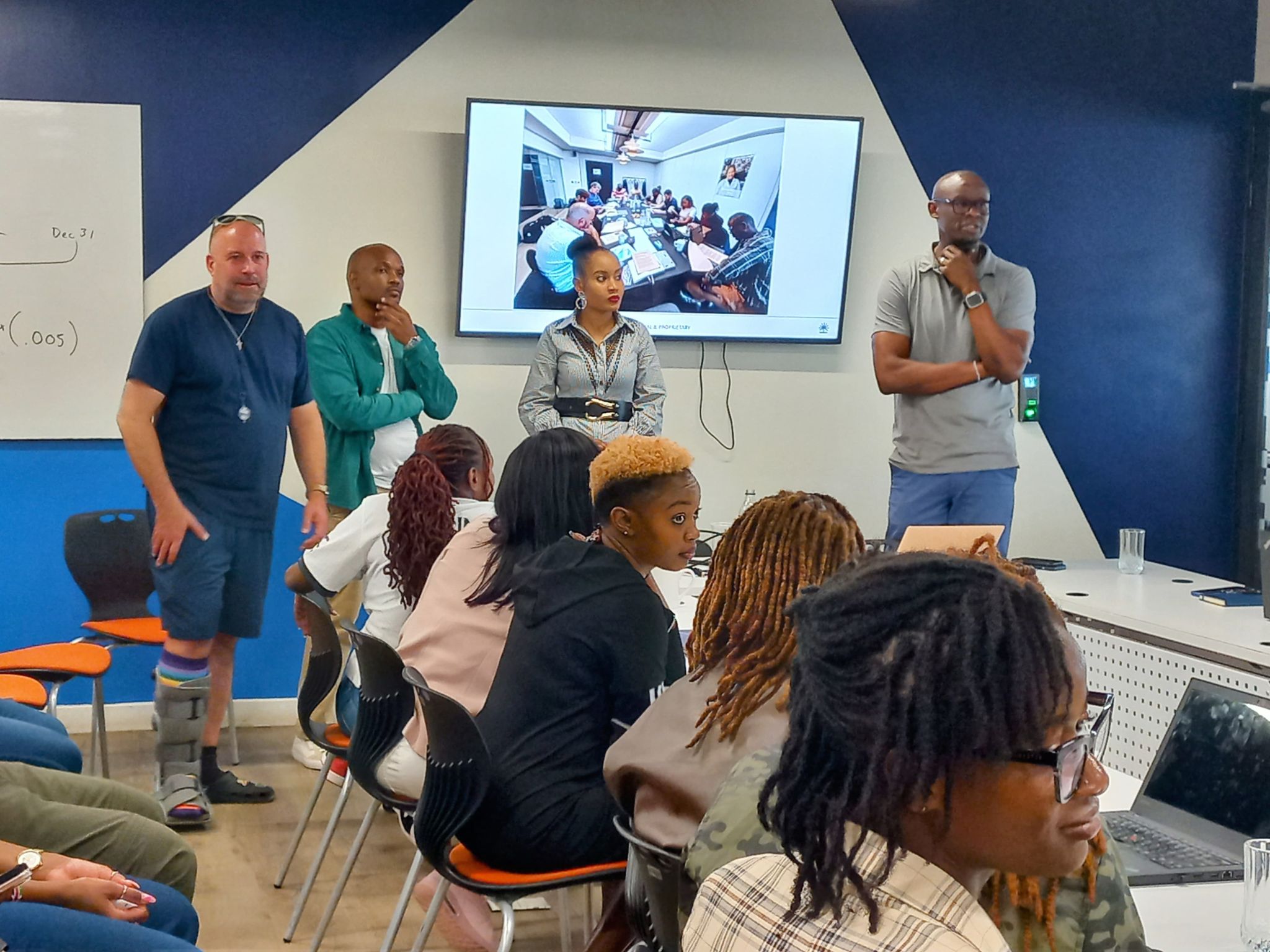

Our friends at the Founder Institute are celebrating the graduation of their 10th cohort at the upcoming fireside chat, “Scaling with Resilience.”

This event will feature insights from experts, founders of venture-backed startups, and experienced investors. It’s also a fantastic opportunity to connect with the Founder Institute Lagos ecosystem, including FI’s network of startups, alumni, partners, investors, and mentors.

Regulation

M-Kopa to pay backlog of tax

Between 2017 and 2019, M-Kopa, the asset financing company whose biggest market is Kenya, remitted zero taxes to the Kenyan Revenue Authority (KRA). Drawing on the UK-Kenya Double Taxation Agreement, a treaty designed to prevent companies from being taxed twice, M-KOPA believed that it shouldn’t pay taxes in Kenya because its directors did not live there. The company also argued that its management decisions are made outside Kenya.

Kenya’s tax authority disagreed and off they went to court. On Monday, a tax appeal tribunal found that the company had not provided evidence that its important operational decisions were taken outside of Kenya, confirming its tax residence in the country.

The ruling meant the company is back on the hook for around KES885.87 million ($6.8 million) in back taxes.

While my colleague agrees that the tax is a small change for a company that has raised $250 million, the ruling may likely set a precedent for other Kenyan startups operating under foreign tax residency.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Startups

CashAfrica is betting on tap-to-pay in Nigeria

CashAfrica’s pitch is pretty simple: why bother with cards when you can use your smartphone to pull cash from a Point-of-Sale terminal? In a country where almost everyone has a phone but far fewer have bank cards, the fintech is hoping this will be the future of payments in Nigeria.

By eliminating card partnerships, CashAfrica significantly cuts costs and improves profit margins, a challenge often faced by Nigerian fintechs dealing with foreign card schemes.

There are clear hurdles: for CashAfrica to thrive, a lot more Nigerians will need to have NFC-enabled phones—and, just as importantly, they’ll need to know how to use them. The tech is promising, but it’s not much good if your customers don’t have the hardware or aren’t sure how to make it work.

Both challenges create a real problem for CashAfrica. User education is timely and costly, and only high-end Samsung and Apple models—which together make up 46% of Nigeria’s smartphone market—come with NFC capabilities. That leaves a significant chunk of the population out of the equation, shrinking CashAfrica’s potential customer base before they’ve even started.

Yet, CashAfrica CEO Malik Asamu chooses to see the positives. His strategy, instead of rational optimism, in a market that is not ready yet is obvious through his comment:

“We believe more NFC-enabled phones will be imported. You don’t want to ride on a wave of innovation when it is sinking. We believe tap to pay is new in Nigeria and we want to be among the first to the market.”

It will also count banks and fintechs as customers as it tries to convince them to adopt its tap-to-pay service.

Fincra secures International Money Transfer Operator (IMTO) licence in Nigeria

Since its inception, Fincra has provided businesses with local payment options. However, with the IMTO licence, Fincra can now manage funds transfers from abroad to Nigerian recipients more efficiently. Read more here.

Startups

Kopo Kopo names new leadership amid Moniepoint acquisition talks

Kenyan fintech Kopo Kopo has announced a leadership shake-up with Dennis Ondeng stepping in as the new CEO, while former CEO Chad Larson transitions to Chief Financial Officer (CFO). Joining the revamped team are Kibet Yegon as Chief Technology Officer (CTO), and Rosemary Muyeshi as Chief Risk Officer (CRO), rounding out the company’s refreshed executive structure.

These leadership changes come 13 months after Kenya’s competition authority approved the acquisition of Kopo Kopo by Nigerian neobank Moniepoint. However, the deal remains in progress, with both companies yet to finalise the transaction.

Kopo Kopo, a provider of payment services and loans to small businesses in Kenya since 2011, could offer Moniepoint a strategic entry point into the Kenyan market.

With its extensive customer base of small and medium-sized businesses, Kopo Kopo’s operations align well with Moniepoint’s suite of business-facing products. As Moniepoint continues its aggressive growth trajectory, an acquisition of Kopo Kopo would solidify its expansion plans in Kenya.

“We have been vocal about our interest in Kenya as part of our mission to provide financial happiness for people across Africa,” the company told TechCabal in August 2023.

If successful, the acquisition could strengthen the connection between Nigeria’s and Kenya’s tech ecosystems, fostering a more integrated African fintech landscape—especially in light of recent partnerships like that between Nigeria’s Rise and Kenya’s Hisa.

Psst  Here’s Paystack Developer Contributor of the month

Here’s Paystack Developer Contributor of the month

Microsoft Engineer Ekene Ashinze built the Angular Paystack Library, a module that helps developers accept payments in their Angular apps with Paystack. Discover his journey in creating the library and how it’s opened doors for him both locally and globally. Learn more →

Inflation

Nigeria’s headline inflation to 32.15% in August

On Monday, Nigeria’s headline inflation fell to a six-month low of 32.15% interest rate in August. It was a second consecutive ease in inflation thanks to a drop in food prices driven by the harvest season. Food inflation also slowed to 37.52% from 39.53% in July 2024.

Nigeria’s headline inflation reached a 28-year high in March after policy changes after the impact of a currency devaluation and partial removal of fuel subsidies affected prices of everyday items. Headline inflation slowed for the first time in 19 months in July.

While August’s figure is far from the CBN’s 21% target, analysts expect the recent increase in fuel prices to drive up the inflation rate in the coming months. Nigeria raised fuel prices by 40% after two months of fuel scarcity.

The slowdown in inflation rate also raises hope of an interest rate hold when the CBN’s Monetary Policy Committee meet on September 24. Since the beginning of the year, the MPC has continuously increased borrowing rates. In June the committee increased borrowing rates to about 26.25%.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $58,084 |

– 0.66% |

– 2.54% |

|

| $2,284 |

+ 0.43% |

– 12.69% |

|

|

$0.77 |

– 1.49% |

+ 155.63% |

|

| $131.37 |

+ 0.63% |

– 7.22% |

* Data as of 04:50 AM WAT, September 17, 2024.

Events

- Catalysing Conversations by Endeavor Nigeria, which brings together Nigeria’s most exciting high-impact entrepreneurs, influential business leaders, and forward-thinking policymakers for inspiration, learning, and networking, is one of the highlights of the Endeavor events calendar. With a projected attendance of 500 curated in-person guests and over 500 virtual audience members, this event promises to be a remarkable gathering of innovation and collaboration. Register here.

- Selar, Africa’s largest creator platform, is hosting its third annual Creator Summit, themed “Living The Pan-African Dream as a Creator.” Taking place on September 20th and 21st, 2024, the program will feature top African creators, actors, and media personalities, including Big Cabal Media’s Tomiwa Aladekomo, Moe Odele, Tunde Onakoya, and more. They will discuss topics about content monetisation and digital entrepreneurship to empower African creators to build sustainable careers in the global marketplace. Apply here to attend.

- Step into the Future with AWS Community Day West Africa 2024! Are you ready to be part of the revolution shaping the next era of tech? Join the trailblazers, visionaries, and innovators who are pushing the boundaries of what’s possible. This is your chance to connect, learn, and ignite your passion alongside the brightest minds in the industry. Don’t just witness the future—be a part of it on September 27th & 28th. Register today.

Issue virtual USD cards for you and your customers

Do you want to issue virtual USD cards for your customers and business expenses? Use Kora’s APIs to issue cards, customise your card program, and set your customers’ funding limit to your risk level. Get started here.

Written by: Faith Omoniyi, & Emmanuel Nwosu

Edited by:Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/W9ZU3aK

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon