Good morning

If TC Daily’s been missing in your mailbox lately, it’s because we’ve been landing in your Promotions folder thanks to an ESP outage.

You can help us solve this by moving TC Daily to your Main/Primary folder so you don’t miss our emails. Simply drag and drop this email if you’re on desktop, or click the menu button and select “Move” if you’re on mobile.

Amsons mega move on Kenya’s Bamburi Cement gets green light

After Swiss building giant Holcim Group posted a staggering $1.927 billion net loss in 2023, CEO Miljan Gutovic said the company would continue its aggressive acquisition strategy that helped it become a global cement manufacturing company.

“If we can, we will do 30 deals if it makes sense,” he said in January. And he made good on that promise. In H1 2024, Holcim acquired 11 companies and divested four—already more than all the deals it did in 2023.

Holcim’s acquisition strategy involves selling off lucrative assets (divesting) to finance new acquisitions. Its latest divestment is Bamburi Cement. Holcim has agreed to sell its 58.6% majority stake in Kenya’s Bamburi Cement to Tanzania’s Amsons Group for $182.8 million (KES23.8 billion), fuelling Amsons’ plan to take full control of the Kenyan cement company.

While the deal still requires approval from other minority stakeholders and regulators, Amsons’ offer values Bamburi at 1.4 times its original value, promising investors a 44.4% premium as of July 10 when the deal was first announced.

Since then, Bamburi’s stock has rallied by 40% for the first time since last year, potentially affecting investor interest.

Amsons has also stated that if it secures 75% or more of the shares, it will consider delisting Bamburi—which recorded a KES399 million ($3.05 million) loss from its Uganda business last year—from the Nairobi Securities Exchange to restructure the business.

Amsons Group, which has a presence in four African countries, sees this as a strategic move to enter the Kenyan market. On the other hand, this signals Holcim’s plan to reduce its East African holdings and focus its operations in Eastern Europe.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that only 2.8% of informal businesses are started out of passion? Click here to find out the motivation of businesses in Nigeria’s informal economy.

Lemfi expands into Mexico and Brazil

Four. That’s the number of countries Lemfi, a Nigerian remittance startup has expanded into this year alone.

The company, which provides money transfer services, began humbly, allowing Nigerians in Canada to send money back home. Soon after, it allowed other Africans in the country send and receive money before expanding into the UK in 2021 through its acquisition of RightCard for $2.5 million. In 2023, it began offering its services in the US after its $33 million Series A.

While the startup was expanding across these markets, CEO Ridwan Oyeniran picked up an important lesson.

“The problems that Africans face in terms of difficulty in sending money and compliance issues are very similar to what people from different emerging markets also face,” Ridwan said in an interview.

That insight led the startup to offer money transfer services to African diasporans in emerging markets like Pakistan, India, China, and its latest additions, Brazil and Mexico.

Yesterday, the startup announced these new markets, allowing Africans in the Latin American markets send and receive money. Brazil and Mexico are the two largest remittance markets in Latin America.

With the latest addition, LemFi now offers its services across 26 countries. The startup which has received a little below $34 million in funding since it was founded in 2019 says it will continue to expand to new markets.

Collect payments anytime anywhere with Fincra

Are you dealing with the complexities of collecting payments from your customers? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. What’s more? You get to save money on fees when you use Fincra. Get started now.

Big Data for Africa’s digital economy

African countries are increasingly turning to big data technology to drive economic growth as the continent pursues its digital economy ambitions. A report by the World Bank found that the digital economy in Africa could be worth $180 billion by 2025. Big data has facilitated the growth of e-commerce in countries such as Kenya, Nigeria, and South Africa by enabling businesses to create novel products and services that cater to customer demands and drive profits.

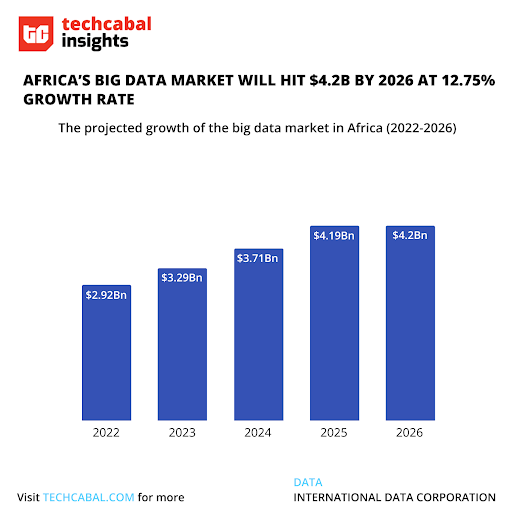

According to a report by the International Data Corporation (IDC), the big data market in Africa is expected to grow at a compound annual growth rate (CAGR) of 12.7% between 2021 and 2026, from $2.92 billion in 2020 to $4.2 billion in 2026.

According to a survey by PwC, 66% of African businesses are using data and analytics to inform business decisions with only 17% considered advanced users. However, these businesses still face obstacles to effectively adopting big data due to infrastructural deficits to support data-driven innovations and growth. Moreover, a survey by Deloitte reveals that 75% of African companies face data quality issues, which can lead to erroneous results and hinder decision-making.

There is conflict surrounding how Africa could harness the potential of big data to drive economic growth while also safeguarding the privacy and security of its citizens’ data. Many African countries lack strong data protection laws and regulations, which can make it easier for data to be accessed, used, or even misused. Access to reliable and accurate data is also crucial for the success of big data analytics projects in Africa. Therefore, African countries need to improve their data collection processes and invest in data quality assessment tools and techniques to overcome this challenge.

As the big data industry in Africa continues to grow, new trends and innovations are emerging as the use of artificial intelligence (AI) becomes more widespread. This will enable businesses to extract insights from vast amounts of data using open data initiatives, which will shape the future of the digital economy in Africa, making it more data-driven, and competitive, and position the continent to become a significant player on a global scale.

Paystack Virtual Terminal is now live in more countries

Paystack Virtual Terminalhelps businesses accept secure, in-person payments with real-time WhatsApp confirmations and ZERO hardware costs. Enjoy multiple in-person payment channels, easy end-of-day reconciliation, and more. Learn more on the Paystack blog →

$1 billion: That’s how much African startups have raised so far in 2024.

Source: Africa: The Big Deal

- You can still get an early bird ticket to the second edition of TechCabal’sMoonshot Conference! From October 9–11, 2024, at the Eko Convention Centre, Lagos, Nigeria, you can join Africa’s biggest thinkers and players like Iyin Aboyeji, Wiza Jalakasi, June Angelides, Kola Aina on a global launchpad for change. If you want to join these stakeholders in Africa’s tech ecosystem for three days of insightful conversations, then get an early-bird ticket to Moonshot 2024 at 20% off.

- Join the 24 Fintech Africa Roadshow Webinar! We’re excited to invite you to our upcoming webinar on Monday, July 29th at 3:00 PM WAT. Discover opportunities for African technology companies at the 24 Fintech Summit, happening from September 3 – 5, 2024, in Saudi Arabia. Speakers include leaders from the fintech industry, providing insights on global fintech trends and opportunities. Don’t miss out on this chance to connect and learn. Register Now.

- Join Career Brunch 2024 on August 17, 2024, in CcHUB with successful professionals from diverse fields and beyond for an exclusive (physical) career hangout for all professionals. Whether you’re a 9-5er, entrepreneur, founder, or young and upcoming professional looking to climb the career ladder, scale your business or transition, Career Brunch has something for you. This is your golden ticket to connect with industry leaders and professionals from MTN, CcHUB, McKinsey, Spotify etc., gain invaluable insights, and supercharge your career trajectory. Get your ticket at www.tix.africa/thebrunch.

You should definitely read these

Written by: Emmanuel Nwosu, Mobolaji Adebayo & Faith Omoniyi

Edited by: Muyiwa Olowogboyega & Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/9EvQHJR

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon