Two months after it raised bridge financing to solve challenges with working capital, the Nigerian business banking startup Brass has been acquired by a consortium of investors led by payment giant Paystack, culminating talks that likely began in early 2024. Other investors include PiggyVest, Ventures Platform, and P1 Ventures.

Investors like Ventures Platform facilitated the conversations and believed the deal had to happen, they also understood the need for operators to also be involved. That pragmatism drove the strategic alliance between the VC firms and the startups in the consortium.

“We’re excited to act as new stewards for Brass’ mission: to enable entrepreneurship for Africans, making it more frictionless, and successful,” the investors told TechCabal in an email.

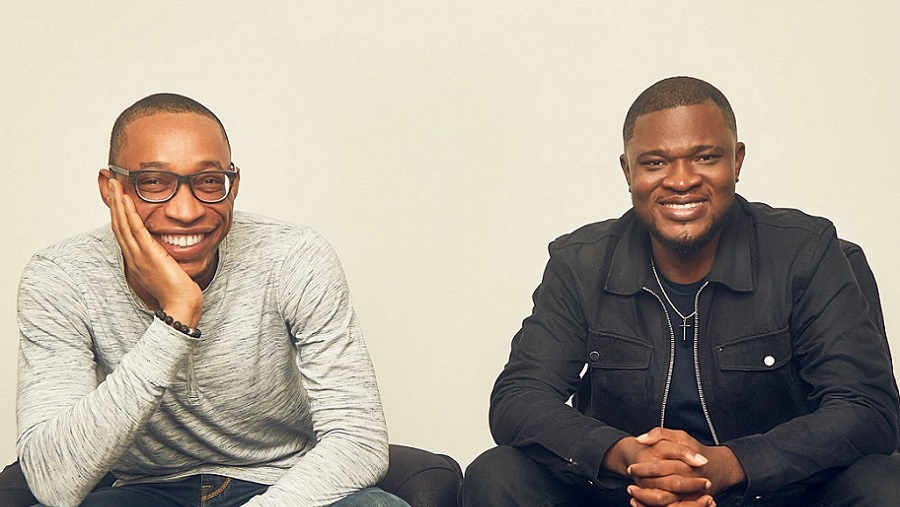

Sola Akindolu, a co-founder and CEO of Brass, Emmanuel Okeke, a co-founder and CTO, and Tolulope Saba, the head of product design, will leave the business. They will be replaced by a new leadership team that has not yet been disclosed. All other Brass employees will keep their jobs, one person with direct knowledge of the matter said.

There will be no change for customers either, with the product remaining largely the same and investors committing to “further investment in product and service improvements.”

The acquisition ends months of uncertainty over the future of Brass after delays in processing customer withdrawals began in October 2023. Those delays continued for months, sparking liquidity concerns and prompting rumours of a shutdown.

Several ecosystem heavyweights rallied around the company, worried that the shuttering of a deposit-taking fintech could cause a bank run on other fintechs. An acquisition by well-trusted and bigger fintechs would calm those fears, so chatter about an acquisition started gathering steam. Moniepoint, Paystack, and Flutterwave were linked to those early talks.

As acquisition talks continued, Brass went to investors to arrange debt financing to allow it remain operational. One early investor who declined to participate in the bridge round claimed Brass was looking to raise $300,000 to $500,000 in convertible debt. The same investor said the business banking startup withheld financial information from investors during that fundraising effort. It is unclear how much Brass eventually raised.

Nevertheless, the new owners will assume Brass’s assets and liabilities, some of which still have significant question marks.

Two people familiar with the company’s finances claim there was a ₦2 billion hole in Brass’s balance sheet. The same people said the company’s leadership could not account for how the money was spent.

“Like many businesses, Brass faced headwinds within the last few months given the difficult business environment,” the investors said in response to questions about those liabilities.

“With a healthy investment of new capital, Brass is in an incredible position to deliver a world-class financial operations stack for businesses in Africa.”

from TechCabal https://ift.tt/ZoIXFzQ

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon