TGIF

Funding for African startups continues to slump in this quarter as a drop of about 45.6% was noticed in comparison to Q1 2023. Another highlight is how debt financing continues to grow as an asset class for these startups.

This quarter, the ecosystem also experienced a number of expansion and acquisitions. Explore more of what went down in African tech in our newly released quarterly report! download it now

Wema Bank removes 7 fintech partners

Wema Bank has taken a strong stance against financial crime after it suffered a ₦685 million ($594,943) loss to fraudulent activities in 2023.

On Wednesday, the Nigerian bank suspended seven unnamed fintech partners from its payment gateway platform. Four partners were suspended, while three were permanently removed from the platform.

Why? Wema’s decision comes after investigations revealed that there had been an increase in fraudulent inflows into some wallet accounts operated by some of its fintech partners using its third-party wallet accounts.

The bank is also conducting audits and reviews of remaining fintech partners to ensure adherence to regulations and compliance with Know-Your-Customer (KYC) guidelines set by the Central Bank of Nigeria. Wema also cited inadequate KYC procedures and compliance issues as contributing factors to the fraud.

A way forward: The Nigerian bank also unveiled an anti-fraud campaign to create awareness, educate and equip customers with the necessary information needed to mitigate, detect and handle fraudulent activities on their accounts.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Kenya demands compliance reports from TikTok

Kenya has been taking steps to regulate TikTok instead of an outright ban. The government has now mandated quarterly compliance reports from TikTok detailing the content removed and the reasons behind it. This aims to address concerns like mental health, data privacy, and online safety.

This comes after a petition was written to Kenya’s Assembly for the ban of TikTok and the platform reaffirmed its dedication to maintaining a safe environment for its users in Kenya. During an appearance before the Kenyan Parliament on April 16, 2024, the platformannounced it will continue to provide capacity-building workshops on online safety, data privacy, and content moderation to Kenyan policymakers and regulatory agencies

The Interior Ministry of Kenya had also considered limiting the use of TikTok by government officials to protect sensitive data and Kenyans’ security. Kithure Kindiki, secretary of the interior cabinet, disclosed then that the National Security Council (NSC) had been battling threats linked to social media platforms, notably TikTok, in its efforts to safeguard national security.

In light of these recent developments, ICT Principal Secretary, John Tanui, informed legislators that TikTok will be mandated to provide quarterly compliance reports to the ministry instead of an outright ban. He emphasises how banning the platform will cause more harm than good for the country as a significant number of their youths rely on it for income.

According to Reuters Institute’s 2023 report, Kenya has the world’s highest TikTok usage rate, with 54% using the app for general purposes and approximately 29% for news.

Enjoy hassle-free transactions with Fincra

Collect payments without stress from your customers via bank transfer, cards, virtual accounts & mobile money. What’s more? You get to save money on fees when you use Fincra. Start now.

Canal+ steps up bid for MultiChoice

French media giant Canal+ has increased its ownership of South African media company, MultiChoice. The company acquired over 3 million additional shares between April 12 and 17, 2024. This surge pushes Canal+’s stake to 40.8%, edging closer to a potential takeover.

The shares were acquired at an average price of R116 ($6.05) per share, lower than the previously announced mandatory share offer of R125 ($6.52).

A shopping spree: Canal+ has been aggressively acquiring shares in MultiChoice. In February 2024, the company crossed a key threshold of 35% ownership, triggering a mandatory offer requirement for MultiChoice shareholders. Since then, Canal+ has continued to buy shares, increasing its stake from 36.6% on April 5, 2024, to its current holding of 40.8%.

Last week, MultiChoice established an independent board— Standard Bank— to evaluate Canal+’s offer and ultimately recommend whether shareholders should accept or reject the bid.

Additional share purchases come after both companies informed investors that they had agreed to work together on the mandatory offer that Canal+ must make to the MultiChoice shareholders.

Zoom out: If shareholders accept the offer and Canal+ acquires at least 90% of MultiChoice shares, it can delist MultiChoice from the Johannesburg Stock Exchange (JSE). MultiChoice and Canal+ intend to post a combined circular to MultiChoice shareholders by May 7, 2024.

Nigeria’s MNOs witness surge in transactions

In Nigeria, mobile money operators are experiencing an uptick.

According to a report by the Nigeria Inter-Bank Settlement Systems (NIBSS), MNOs experienced an increase in transactions during the first quarter of 2024. The total value of transactions from January to March 2024 reached N17.2 trillion. This represents an 89% year-on-year growth compared to the same period in 2023 when transactions amounted to ₦9.1 trillion ($7.9 billion).

The data analysis reveals consistent growth each month, with transactions increasing from ₦5.2 trillion($4.5 billion) in January to ₦6.5 trillion($5.6 billion) in March, indicating a steady trend in mobile money usage. All electronic channels in the country surged by 89% in Q1 2024, reaching ₦234 trillion ($203 billion).

What do we have to thank? Industry analysts attribute this surge to several factors, including recent cash shortages and the implementation of the cashless policy by the Central Bank of Nigeria (CBN). We know you remember the cashless policy,which came into effect on January 9, 2023, and imposed limits on cash withdrawals, with individuals restricted to withdrawing up to ₦500,000 ($434) and corporate organizations limited to ₦5 million($4,346) per week. This policy likely served as a catalyst for individuals and businesses to conduct more electronic transactions, contributing to the overall increase in e-payment activities across Nigeria.

Nigerian mobile money operators are divided into two: bank-led (offered by traditional banks) and non-bank-led (companies like OPay and Palmpay). With over 200 fintech companies in Nigeria, only 17 are licensed for mobile money services.

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

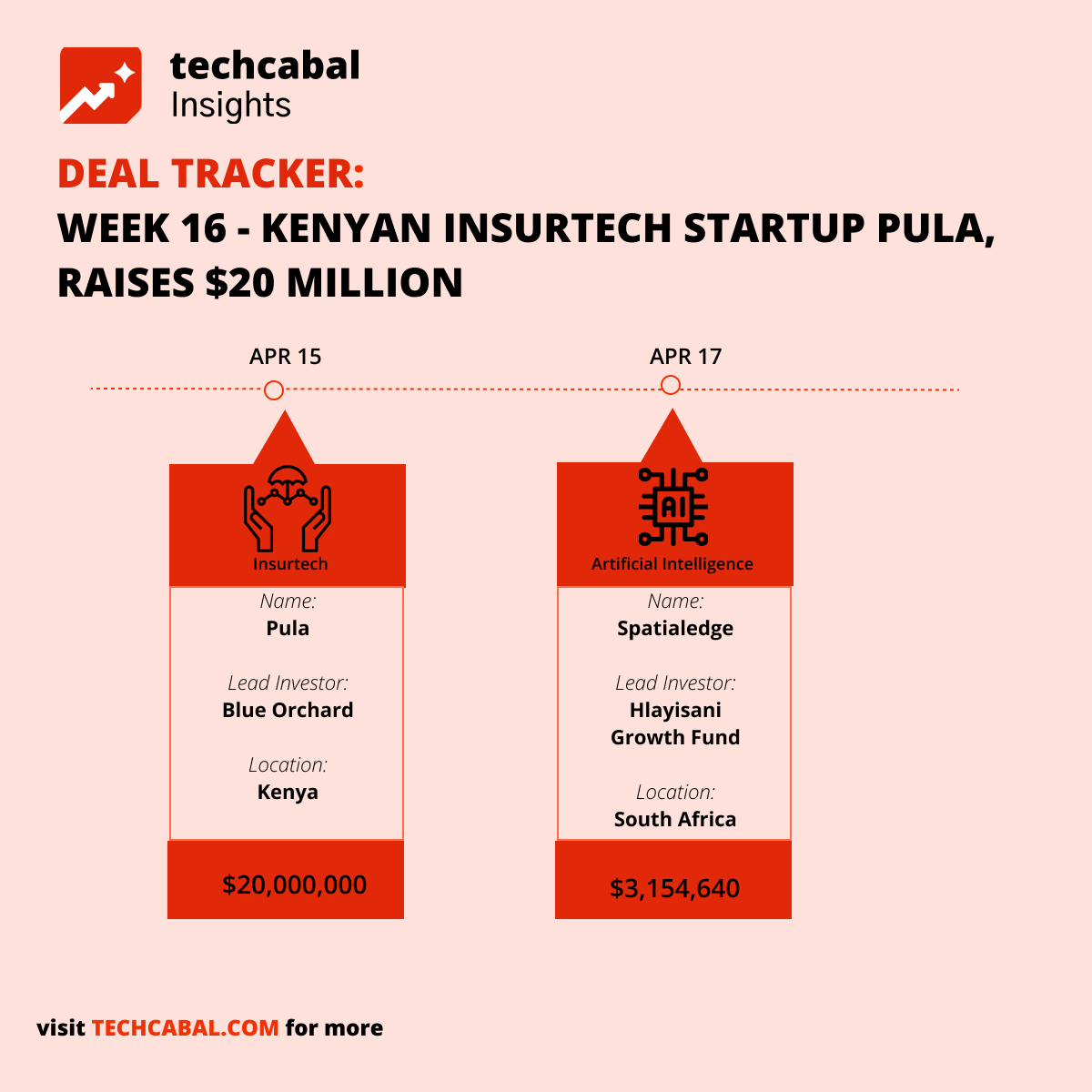

Funding tracker

This week, Pula, a Kenyan insurtech startup, secured $20 million in Series B funding in a round led by global investment manager BlueOrchard via its InsuResilience strategy. Other participants include the IFC’s $225 million venture capital platform, the Bill & Melinda Gates Foundation, Hesabu Capital, and existing investors.

Here’s the other deal for the week:

- Spatialedge, an AI-driven software company in South Africa, received $3.15 million from the Hlayisani Growth Fund.

Before you go, our State Of Tech In Africa Report for Q1 2024 is out. Click this link to download it.

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

Attend GITEX Africa

GITEX Africa returns a second time on May 29–31, 2024, to Marrakech, Morocco, discussing ways to accelerate the continent’s digital health revolution. GITEX is the continent’s largest all-inclusive tech event renowned for uniting the brightest minds in the technology industry.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $63,735 |

+ 3.73% |

– 5.61% |

|

| $3,073 |

+ 2.41% |

– 12.60% |

|

|

$1.00 |

+ 0.05% |

+ 0.07% |

|

| $551.34 |

+ 2.37% |

– 0.71% |

* Data as of 10:15 PM WAT, April 18, 2024.

- Moniepoint – Business Operation Manager – Lagos, Nigeria(Hybrid)

- Ergeon – Senior Full Stack Engineer – Nigeria (Remote)

- FairMoney – Backend Engineer– Nigeria (Remote)

- Daily Maverick – Project Manager – South Africa (Hybrid)

- Kuda Bank – Data Engineering Intern– Nigeria (remote)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

Here’s what you should be looking at

Written by: Mariam Muhammad & Towobola Bamgbose

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/bUFhu69

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon