We’re thrilled to announce that TechCabal Battlefield is back, and this time, it’s bigger and better than ever before!

TechCabal Battlefield is Moonshot’s startup competition dedicated to spotlighting and showcasing African startups to a global audience, providing winners with exciting prizes. This year, we’re bringing more value to our participants including a pre-accelerator program, deal room sessions and so much more.

We invite you to be part of this incredible journey by applying to TC Battlefield 2024. If you’re a startup founder building innovative tech solutions to solve Africa’s unique challenges, TC Battlefield is the platform for you. Apply now at bit.ly/tcbattlefield.

A $2.1 million debit card fraud hits Equity Bank in Kenya

Equity Bank, the largest bank in Kenya, has fallen victim to a debit card fraud scheme resulting in the theft of $2.1 million.

As a response, the bank has frozen all 500+ accounts involved in the receipt of these funds. Per a detective from the Directorate of Criminal Investigation, 19 individuals have been apprehended in connection with the crime.

How did the fraud happen? Sources with knowledge of the investigation claim the scam involved a “card-not-present” scheme, in which fraudsters don’t need physical possession of the card. This type of fraud typically entails the use of stolen card information for online shopping or the creation of fraudulent websites to process payments and access funds.

Kenyan banking regulations mandate the disclosure of information for transactions exceeding $10,000, and mobile wallet transactions are capped at $1,900 per transaction with a maximum of $3,800 daily. The stolen funds were distributed across over 500 bank and mobile money accounts to avoid detection.

According to a letter signed by Gerald Munyiri, Equity’s general manager security, between April 9 to 15, 2024, $1.3 million was paid out from the general ledger fraudulently to 551 Equity Bank accounts, $478,360 was sent to Safaricom, and $296,015 to eleven commercial banks.

Fraud on the rise in Kenya: Kenyan banks reportedly lose about $130 million to cybercrime annually, and card fraud is just one facet of this problem. Regulatory agencies are tracking suspicious financial flows to combat money laundering and terrorist financing alongside fraud. In February 2024, the East African country found itself on the Financial Action Task Force’s (FATF) grey list again after 10 years.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

MarketForce shuts down RejaReja, switches to social commerce

Kenyan B2B e-commerce startup MarketForce has been in the news recently. In October 2023, the company scaled back operations in three African markets— Nigeria, Rwanda, and Tanzania.

In December, Marketforce also faced challenges with its credit partner Pezesha. The companies had partnered up in 2021 to allow Pezesha to offer cost-effective financing for inventory and wholesale distribution to merchants partnered with Marketforce. By September 2023, however, Pezesha submitted a petition to liquidate Marketforce’s assets due to an outstanding debt.

MarketForce is now adapting to the market realities and has decided to shut down RejaReja, its B2B e-commerce platform that is a huge part of its business, and focus on a new venture: Chpter, a social commerce startup.

MarketForce co-founder Tesh Mbaabu cited razor-thin margins and intense price competition as key factors. He also mentioned difficulties with the capital-intensive nature of the business model.

A new Chpter: MarketForce’s new venture, Chpter, will provide AI-powered chat automation tools for businesses on platforms like WhatsApp and Instagram, which will allow streamlined communication between businesses and customers and potentially convert social media interactions into sales.

Enjoy hassle-free transactions with Fincra

Collect payments without stress from your customers via bank transfer, cards, virtual accounts & mobile money. What’s more? You get to save money on fees when you use Fincra. Start now.

SafeBoda launches electric motorcycles for a greener Uganda

Uganda’s Ride-hailing platform SafeBoda has launched a new electric motorcycle option, called Electric Boda. This new service was announced via apost on X on Tuesday, April 16, 2024.

Why electric? Boda bodas, the motorbike taxis used in Uganda’s urban areas, are a convenient and affordable way to get around. However, they also contribute to air and noise pollution. Electric Boda will be offering the same convenience without the environmental drawbacks.

Are there benefits to using electric bikes? SafeBoda’s electric bike initiative promises a win-win-win situation. The world has been pushing for environmental safety precautions. The use of electric bikes will translate to cleaner air in cities, a quieter ride for everyone, and potentially lower costs for both riders and the company.

Challenges of using electric bikes in Uganda: Uganda lacks a widespread network of charging stations for electric vehicles. SafeBoda will need a solution to keep their electric motorbikes powered up. Additionally, finding trained mechanics and spare parts for these new bikes might be a challenge initially.

Despite the challenges, SafeBoda’s electric push is a positive sign for Uganda’s transportation future. This move comes alongside the company’s recent announcement to return to Kenya’s capital, Nairobi. SafeBoda seems to be back on the growth track, and this time, it’s with a focus on sustainability.

Cellulant appoints new leaders

After securing $54.5 million through three funding rounds between 2014 and 2018, Cellulant, a pan-African payments company, faced challenges securing further investment. An attempt to raise $100 million in a Series D round in 2022 fell short.

This funding shortfall coincided with a period of internal restructuring. In 2023, Cellulant undertook three rounds of layoffs. The latest quietly happened in December 2023, just one month before then-CEO Akshay Grover, stepped down, citing personal reasons. At least four high-profile executives also left the company in Q4 of 2023, and chief financial officer Peter O’Toole was appointed acting CEO.

Adding to the many strategic shifts in 2023, Cellulant revealed the Central Bank of Nigeria (CBN) withdrew its mobile money licence in December 2023, as it decided to focus on payment solutions.

Now, Cellulant has rebuilt fresh leadership for its new focus. Andy O’Sullivan, co-founder of Innovate Payments, is taking the helm as Cellulant’s new chief technology officer (CTO). Gbenga Haastrup, with experience in risk and compliance, joins as Executive Consultant.

Additional appointments include Irene Koki as head of internal audit, Ochebhoya Ekpete as VP of group finance, and Susan Fouche as group chief people officer.

A new focus: According to O’Toole, Cellulant aims to become a “highly sustainable and profitable payments company” focusing on three key areas: checkout, payout, and banking solutions. The company plans to prioritise product development, service delivery, streamlined operations, and risk management in 2024.

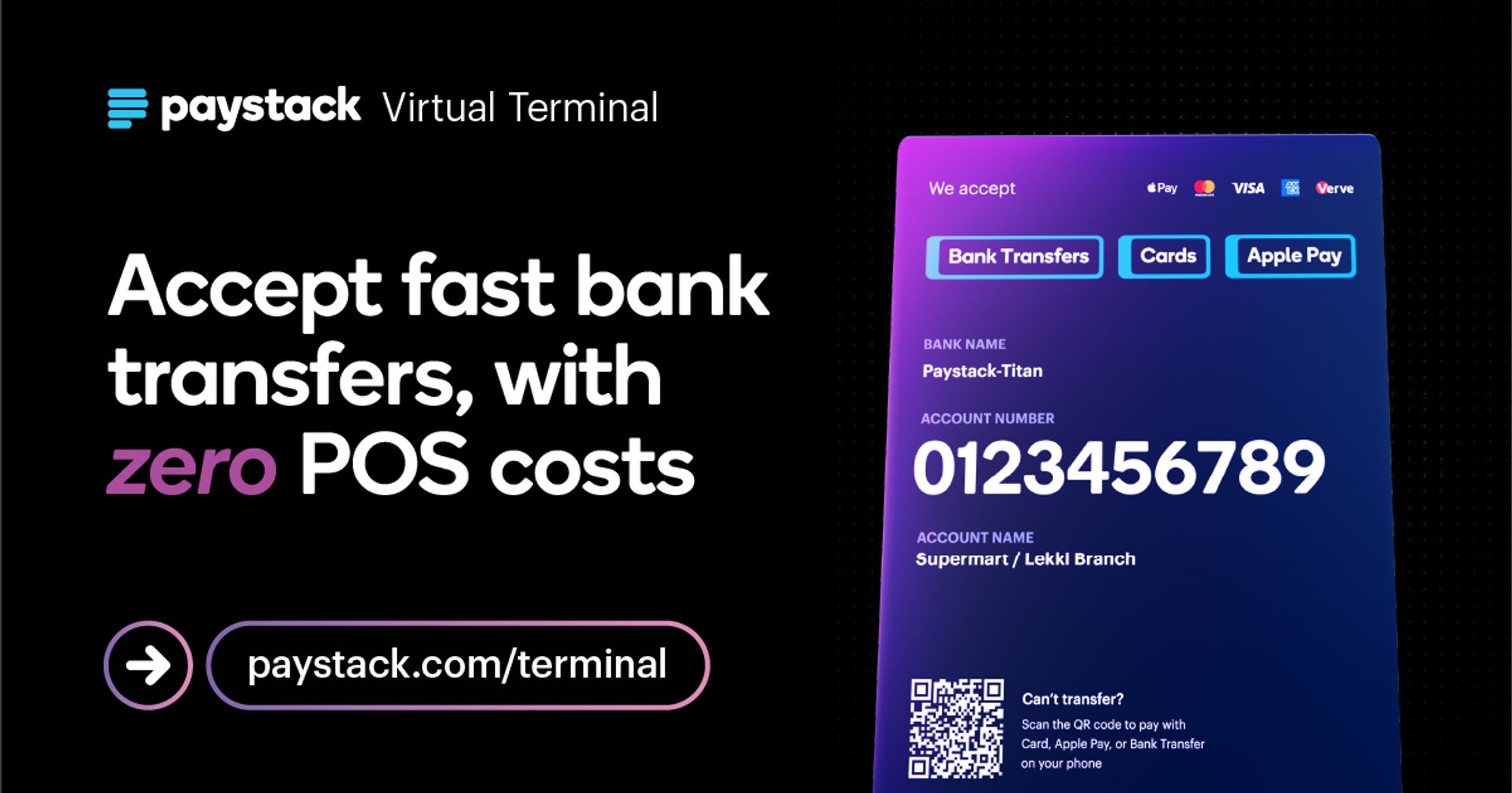

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

Kenya cracks down on tax evasion

Kenya Revenue Authority (KRA) is considering a new transfer pricing database to enhance tax compliance and combat tax evasion among multinational corporations.

What is transfer pricing: Transfer Pricing (TP) involves setting appropriate prices for goods, services, loans and intangibles supplied or transferred by one enterprise to another; both of them being members of the same group or otherwise connected. For example, when a subsidiary company sells goods or services to its parent or another affiliated one, the transfer price is the fee charged for these transactions.

Some big multinational corporations have been using transfer pricing in a tricky way to avoid paying taxes. They set up these transfers so it looks like they’re making less money than they really are, especially in countries with high taxes.

This is a concern for the Kenya Revenue Authority(KRA) because it means they miss out on taxes and revenue meant to be generated. To fight this, the KRA is considering a new transfer pricing database.

What will this database do? This database will assist KRA agents in compiling, analying, and managing data from cross-border transactions.

The KRA is also planning to add more details about the transactions they will track. This includes pricing and profit information. This will help them see how much money companies are making on different types of transfers.

Comparisons: The KRA will also able to compare a company’s transfer prices to similar situations. This will help them see if a company is setting artificially low prices to avoid taxes.

This initiative comes months after the national treasury released a draft income tax rule that could affect more businesses. This new rule aims to ensure all companies pay their fair share of taxes, even when they do business with themselves across borders.

Attend GITEX Africa

GITEX Africa returns a second time on May 29–31, 2024, to Marrakech, Morocco, discussing ways to accelerate the continent’s digital health revolution. GITEX is the continent’s largest all-inclusive tech event renowned for uniting the brightest minds in the technology industry.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $61,200 |

– 4.39% |

– 10.35% |

|

| $2,988 |

– 3.50% |

– 17.85% |

|

|

$0.9999 |

– 0.04% |

+ 0.05% |

|

| $535.48 |

– 1.22% |

– 6.72% |

* Data as of 11:05 PM WAT, April 17, 2024.

- The second edition of TechCabal’sMoonshot Conference is set for October 9–11, 2024, at the Eko Convention Centre, Lagos, Nigeria. Moonshot will assemble Africa’s biggest thinkers, players and problem solvers on a global launchpad for change. If you want to join the stakeholders in Africa’s tech ecosystem for three days of insightful conversations, then get an early-bird ticket at 20% off.

- Nigeria’s biggest women-only festival, Hertitude, is back for a third time. For those new to the scene, Zikoko brings all the girls to the yard every year to let their hair down, form bonds and celebrate what it means to be a hot babe. It’s happening on April 20, 2024 in Lagos and will feature everything from talent shows and karaoke sessions to spa services, live music performances and an afterparty. Click here to get tickets.

- Attention all music lovers! On Saturday, May 11, 2024, Zikoko wants you outside for a day of link-ups, games, drinks and live performances at Muri Okunola Park, Lagos. Strings Attached is an opportunity for friends to reconnect, lovers to bond and individuals to make friends and build community. To get a free ticket, download the Onebank by Sterling App and sign up using ZIKOKO as the referral code. You’ll get your ticket in your email once tickets are available. Click here to get the app.

Here’s what you should be looking at

Written by: Mariam Muhammad & Towobola Bamgbose

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/a2HFIct

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon