Good morning

TechCabal Insights has partnered with the Japan International Cooperation Agency (JICA) to release a report on the Nigerian startup scene.

The report covers the state of the Nigerian startup ecosystem by taking a bird’s eye view of the macroeconomic and regulatory events that continue to shape it. It provides a robust SWOT analysis of the tech landscape, the factors that can catalyse the growth of Nigerian startups, and sectors where innovation can drive this growth, among other vital information.

Get the actionable insights you need to navigate the Nigerian startup scene. Download your FREE report here.

Binance executive arrested in Kenya

While Africa has seen its fair share of sluggish extradition processes, with cases languishing for years in legal limbo, the unfolding saga of Nadeem Anjarwalla, a Binance executive who escaped custody in Nigeria and fled to Kenya using a smuggled passport, has taken a surprisingly swift turn.

A short-lived escape: One week after Nigeria asked Kenya to arrest and extradite Anjarwalla, the Kenyan police, in collaboration with Nigerian authorities and Interpol, have reportedly arrested Anjarwalla with plans to expedite his extradition back to Nigeria within the week.

Anjarwalla’s story began in February when Nigerian authorities detained him and another Binance executive, Tigran Gambaryan, on suspicion of tax evasion.

Nigerian authorities seized their travel documents, which marked the beginning of a tumultuous series of events that would ultimately see Anjarwalla escaping the country to Kenya on March 25, leaving Gambaryan behind to face money laundering charges.

Zoom out: Binance and its executives face charges in Nigeria for tax evasion, currency speculation, and money laundering of an alleged $35.4 million. One executive, Gambaryan, pleaded not guilty and applied for bail but it was denied due to Anjarwalla’s escape. Gambaryan’s bail hearing was reportedly rescheduled for yesterday, April 22, but it is unclear at this point what the verdict is.

*This is a developing story.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Thepeer to return $350,000 to investors after shutting down

The Nigerian startup scene has seen its fair share of success stories in recent years. Fintech companies like Flutterwave and Paystack have become household names and facilitated digital payments across the continent. But the journey for startups can be challenging and newer ventures grapple with the harsh realities of the market.

This year alone, two promising startups have closed shop. In January, Cova, a wealthtech platform aiming to be the one-stop shop for asset management, shut down due to challenges in gaining traction. Cova, however, chose to return some capital to its investors, even in defeat.

In April 2024, Thepeer, an API startup focused on connecting business wallets, followed suit. Now, the startup is expected to return about $350,000 of the $2.3 million it raised to investors after it promised them 20% of their funds back (around $460,000.)

Challenges faced: Although Thepeer had runway for another 20 months, it shuttered operations due to its inability to secure product-market fit. According to a source with knowledge of the company’s finances, despite processing over $500,000 in transactions during the first three quarters of 2023, the company generated less than $1,000 in revenue.

Sources also claim that before Thepeer shut down, it explored alternative products like fraud prevention but wasn’t convinced enough to pivot with investor funds. Acquisition talks with other startups also didn’t materialise.

Enjoy hassle-free transactions with Fincra

Collect payments without stress from your customers via bank transfer, cards, virtual accounts & mobile money. What’s more? You get to save money on fees when you use Fincra. Start now.

TLcom Capital raises $154 million for TIDE Africa II

In 2023, African startups raised $3.2 billion, the lowest figure since the $2.1 billion in 2020. Despite the recent slowdown in global venture capital funding, there’s good news for African startups looking for funding as TLcom Capital, a Nairobi-based venture capital (VC) firm has successfully closed its TIDE Africa II fund at $154 million.

This new fund is a significant increase compared to TLcom’s first Africa-focused fund, which closed at $71 million in 2020. The larger size reflects growing confidence in the African tech ecosystem as local VC firms like TLcom are stepping up to fill the gap.

Who are the investors? Leading institutions like the European Investment Bank (EIB) and Visa Foundation are backing TIDE Africa II. TLcom will invest in 20-25 startups, primarily focusing on seed or Series A funding rounds, ranging from $1 million to $3 million.

TLcom Capital also plans to fund female-founded tech startups. TLcom was an early investor—$2 million—in FirstCheck Africa, a female-focused pre-seed fund launched in January 2021.

What to look out for: The fund will enable TLcom to expand its reach to Egypt and South Africa, partnering with local founders who are tackling Africa’s biggest challenges with innovative solutions. Investments have already been made in promising companies like LittleFish, a software company enabling payment and banking products for retail-focused SMBs, and Cairo-based logistics company ILLA.

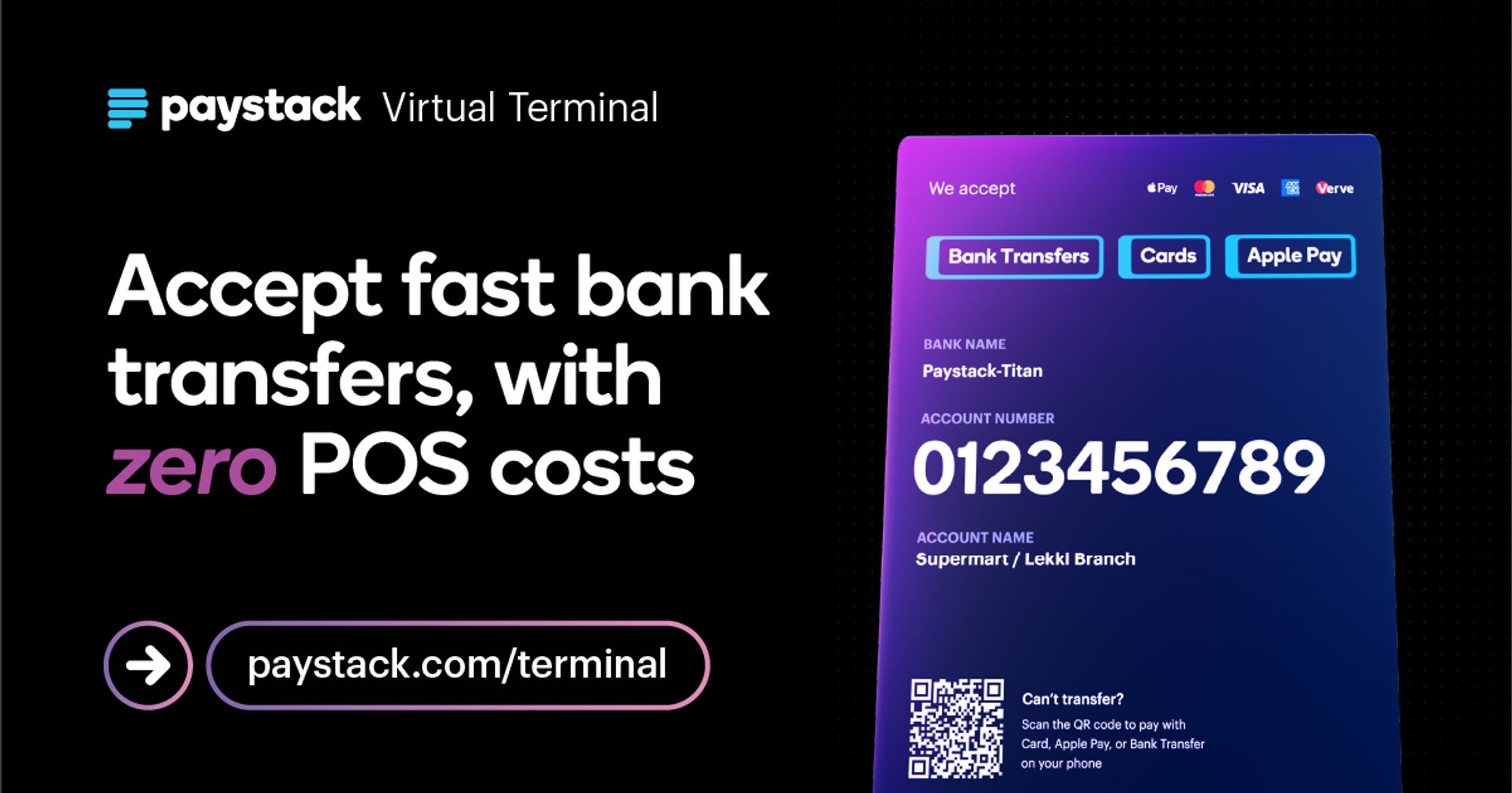

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

More crypto businesses licensed in South Africa

Yesterday, South Africa’s Financial Sector Conduct Authority (FSCA) approved 16 extra operating licences for crypto businesses. This, in addition to the 59 operating licences approved in March 2024, brings the total number of licenced crypto companies to 75.

Altcoin Trader, Luno and VALR (pty) LTD were some of the most recognisable names with Binance missing from the list.

The FSCA began the process for crypto access service providers in June 2023 while requiring them to submit their licence applications by November 2023.

These licenced companies offer different services and different business models including advisory services, exchanges, payment gateways, crypto-to-crypto tokenisation, etc These licensed crypto companies will be under supervision to make sure they follow the rules.

With the regulator expected to approve even more licences, the “FSCA warns that any unlicensed entity offering crypto-related financial services will be subject to investigation,” said Felicity Mabaso, head of licensing, FSCA.

The move to license 75 crypto businesses signifies South Africa’s continuing acceptance of cryptocurrency which will position South Africa as one of the continent’s crypto-forward countries.

Bolt partners with M-Kopa, Roam and others to launch eco-friendly rides

Commuters can now request eco-friendly motorcycle rides as Bolt is taking a green route in Kenya.

The company says it plans to onboard 1,000 electric bikes on its platform by the end of the year, and 5,000 more over the next two years.

This introduction is in partnership with several companies like Roam Electric, Ampersand, both electric vehicle producers and M-KOPA, a financing company. This means that commuters can now order “boda boda” eco-friendly rides from the comfort of their homes.

Caroline Wanjihia, Bolt’s regional director for ride-hailing operations in Africa and international markets, expressed excitement about the strategic partnerships facilitating the introduction of electric bikes. “We are excited to introduce our electric bike fleet, in partnership with M-KOPA, as part of our ongoing efforts to support and empower our drivers. This marks a significant milestone in Bolt’s mission to provide sustainable and financially viable transportation solutions in Kenya,” Wanjihia said.

A greener option: Bolt’s partnership with M-Kopa, Kenya’s major electric motorbike financier, will make electric bikes more affordable for the platform’s riders. M-Kopa’s fintech will subsidise the motorcycle costs, allowing Bolt drivers to access electric bikes at prices comparable to petrol alternatives. While electric bikes typically cost between KES240,000 ($1,791) and KES250,000 ($1,865), Bolt drivers can now obtain them for as low as KES10,000 ($74.6) to KES15,000($111) through M-Kopa’s vehicle financing.

African countries are going green. In April, Uganda’s Ride-hailing platform SafeBoda also went green by launching a new electric motorcycle option, called Electric Boda.

Attend GITEX Africa

GITEX Africa returns a second time on May 29–31, 2024, to Marrakech, Morocco, discussing ways to accelerate the continent’s digital health revolution. GITEX is the continent’s largest all-inclusive tech event renowned for uniting the brightest minds in the technology industry.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $66,976 |

+ 1.09% |

+ 4.12% |

|

| $3,191 |

– 0.19% |

– 3.94% |

|

|

$0.78 |

– 5.34% |

+ 10.10% |

|

| $156.52 |

+ 3.79% |

– 9.14% |

* Data as of 05:30 AM WAT, April 23, 2024.

- The fourth edition of Pitch2Win is open for applications. Pitch2Win aims to connect visionary founders with potential investors, fostering growth, collaboration, and investment opportunities. The 3 Finalists will win from a prize pot of $20,000. They will also receive an all-expense paid trip to the IVS2024 Kyoto Event, Japan’s largest startup conference. Apply by May 5.

- Applications are open for the FC Startup Innovation Challenge. African tech entreprenuers will get a chance to win a $1,000 equity-free cash prize plus up to $300,000 worth of incredible perks from Paystack, Google for Startups, Intercom, AWS, Founders Factory to fuel your startup’s growth. Apply by April 28.

- Applications are open for the 5th edition of Wema Bank’s startup-focused tech competition, Hackaholics, themed “Meta-Idea: DigiTech Solutions for Africa’s Prosperity”. The edition will be executed over six months, touring 10 universities across Africa and challenging the youths to pitch unique, innovative, and practical Digi-Tech solutions to positively impact the acceleration of progress, development, and prosperity in Nigeria and across the African continent. The best innovators in Africa will be awarded ₦70 million. Apply here.

Here’s what you should be looking at

Written by: Mariam Muhammad & Towobola Bamgbose

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/1Lrs5FK

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon