Good morning

Come and get an exclusive scoop into the State of Tech in Africa in Q1 2024. This Friday, April 12, by 11 AM (WAT), TechCabal will launch its SOTIA report which spotlights important trends in Q1 2024 while also delving deeper into the nitty gritty of various happenings in Africa’s Tech Space.

As a stakeholder in Africa’s Tech Ecosystem, these insights will help you position strategically and uniquely to harness the innovative progress within this sector. Register here now to make sure!

Binance executive remanded to prison

If you wager on the Nigeria-Binance saga becoming a Netflix series, this writer thinks you have a fair shot at winning. The plot thickens as Binance’s detained executive has been sent to the Kuje prison, one of Nigeria’s infamous prisons.

ICYMI: Last week, Binance wrote to Nigeria to release its detained executive, Tigran Gambaryan, who had been in detention since February. Gambrayan was charged by Nigeria’s anti-graft agency, the Economic and Financial Crimes Commission on four counts of money laundering charges and was also served tax evasion charges alongside Binance by Nigeria’s tax collector, Federal Inland Revenue Service.

The news: Gambaryan who first appeared in court last week, yesterday, pleaded not guilty to the money laundering allegations. Gambaryan also asked not to be linked with charges of his colleague Anjarwalla who escaped the country.

The judge, Justice Emeka Nwite, was not convinced, however, rejecting his request not to be tried with Anjarwalla.

What’s next? Gambaryan will stay in Kuje jail until the judge decides on April 18 if he can get bail. The trial against him won’t start until May 2.

Binance, since last week, has been clamouring for the release of its executive. “We are deeply disappointed that Tigran Gambaryan, who has no decision-making power in the company, continues to be detained,” a Binance spokesperson said in a Bloomberg article.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Zimbabwe prepares for smooth online transactions as ZiG currency launches

The Reserve Bank of Zimbabwe, the country’s financial regulator, has explained that it expects online platforms to start processing transactions smoothly on Friday, April 12, 2024, as the country adjusts to the new currency, Zimbabwe Gold (ZiG).

What happened? On April 5, 2024, the apex bank released a monetary policy statement to announce its gold-backed currency, the country’s latest attempt to staunch the inflation of its currency.

Following this change, online payment platforms in the country were unable to process transactions with the Zimbabwean dollars, which was replaced by the ZiG.

The effect of this switch: This switch caused some citizens to be temporarily unable to pay for things online. Banks and payment providers stated that they could not support payments because they had to recalibrate their systems to the new currency

Some citizens expressed facing difficulties in making online payments for goods and services. Banks and payment providers explained that they couldn’t facilitate payments because they needed to adjust their systems to accommodate the new currency.

The adoption of online transactions has been sluggish among Zimbabweans due to the county’s preference for cash-based transactions in more stable currencies such as the South African rand, Botswana pula, and US dollar. This preference stems from a distrust of having funds in bank accounts, fearing sudden government-mandated conversions to unstable currencies, as witnessed in the past.

No hidden fees or charges with Fincra

Collect payments via Bank Transfer, Cards, Virtual Account & Mobile Money with Fincra’s secure payment gateway. What’s more? You get to save money for your business when you use Fincra. Start now.

Canal+ acquires more MultiChoice shares, new board to determine buyout

Since 2020, French media giant Canal+ has been on a mission to acquire African pay-TV leader, MultiChoice. Its initial stake of 20.1% steadily grew to 35% in February 2024, which triggered a mandatory offer under South African law, forcing Canal+ to formally offer to buy MultiChoice’s remaining shares for R125 per share ($6.71). This valued MultiChoice at R55 billion ($2.9 billion).

Although an agreement hasn’t been reached, Patrice Motsepe, South Africa’s wealthiest Black man, got involved in the deal in March. This move is seen as a potential way to overcome South African regulations that limit foreign ownership of broadcasters to 20%, to ensure MultiChoice remains a South African entity.

Now, the long-running saga of MultiChoice’s ownership has finally leaped forward.

What’s new? MultiChoice has established an independent board— Standard Bank— to evaluate Canal+’s offer. This board will ultimately recommend whether shareholders should accept or reject the bid. While the offer is being considered, Canal+ hasn’t stopped acquiring shares. As of April 5, 2024, Canal+ held over 36.6% of MultiChoice, up from the 35% held in February 2024.

If shareholders accept the offer and Canal+ acquires at least 90% of MultiChoice shares, they can delist MultiChoice from the Johannesburg Stock Exchange (JSE).

MultiChoice and Canal+ intend to post a combined circular to MultiChoice shareholders by May 7, 2024.

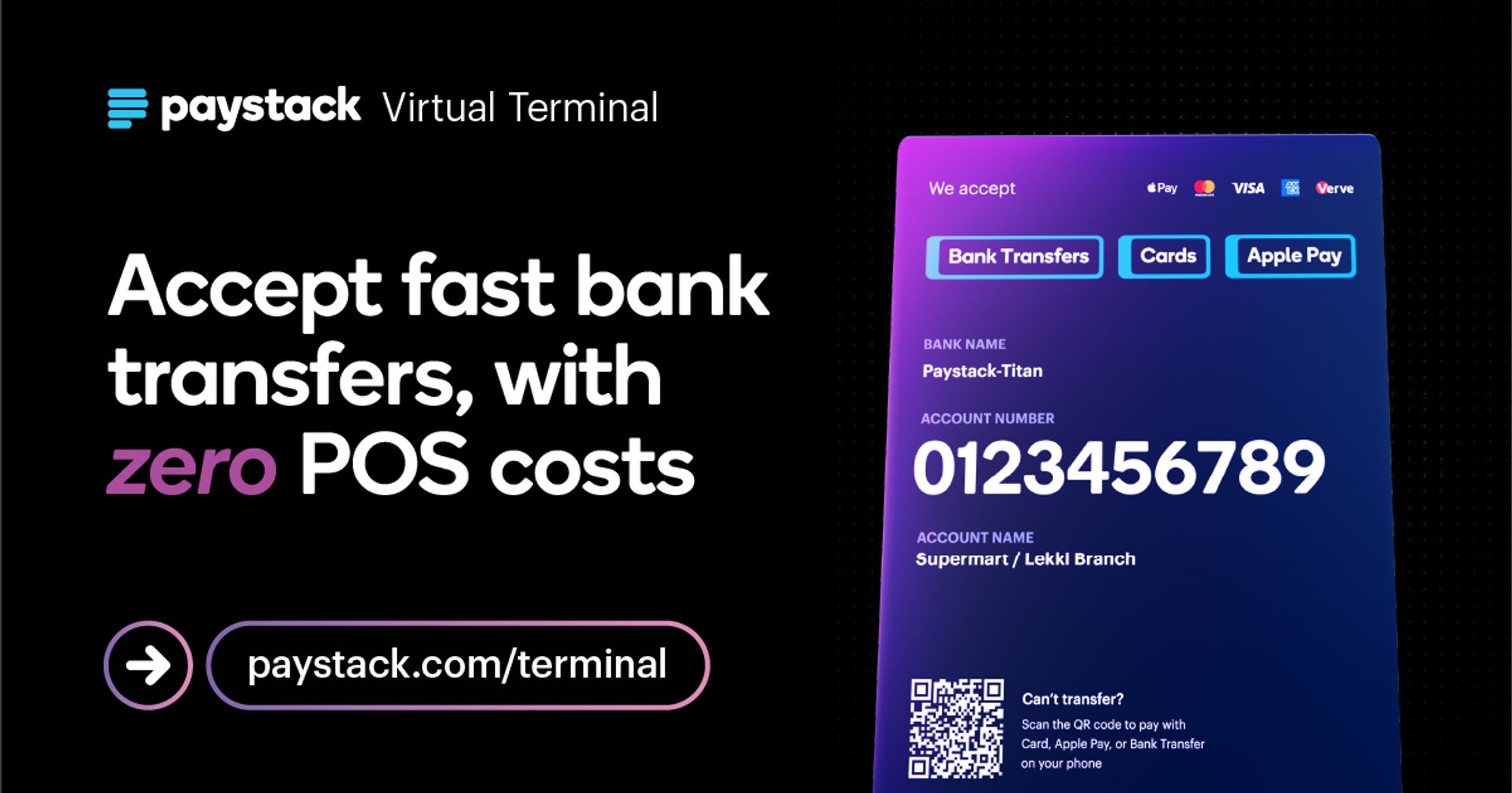

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

First Bank of Nigeria to raise $231 million to meet new capital requirements

In Uganda, stricter capital requirements implemented in July 2023, forced some banks to downgrade operations. Guaranty Trust Bank Uganda, a subsidiary of a prominent Nigerian bank, was one such institution after it applied to become a credit institution due to challenges meeting the new capital buffer of $38.6 million in capital reserves.

The focus on strengthening financial institutions has now reached Nigeria, as the country’s apex bank, on March 28, increased the minimum capital requirements for banks to $364.56 million by March 31, 2026, to address rising macroeconomic challenges.

Unlike their Ugandan counterparts, Nigerian banks are taking the challenge in stride.

First Bank Holdings, for instance, is holding a shareholder meeting later this month to discuss raising an additional $231 million through public offerings, private placements, or rights issues in domestic or international markets.

Access Holdings, the parent company of Nigeria’s biggest bank by assets— Access Bank— isn’t sitting idle either. It previously announced plans to raise $1.8 billion to meet the CBN’s directive, and expand its operations over the next four years as it targets becoming one of the continent’s largest lenders. This capital raise will involve a combination of bond or share sales and a rights issue targeting existing shareholders.

Tiered requirements: The new capital requirements are tiered based on a bank’s operational scope. International commercial banks face the highest hurdle, needing to raise $364.56 million. Access Bank, with its international presence, falls into this category. National and regional banks have lower targets of $160.8 million and $40.2 million, respectively.

Global Strategies for Success in Africa: Overcoming FX and Payment Hurdles

Join Verto as it explores Africa’s business landscape, master international pitches, navigate currency fluctuations, and forge strategic alliances for financial resilience. Register now.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $71,103 |

+ 2.22% |

+ 2.25% |

|

| $3,395 |

+ 7.85% |

– 6.45% |

|

|

$1.36 |

+ 17.19% |

+ 97.77% |

|

| $177.84 |

+ 0.59% |

+ 20.46% |

* Data as of 06:21 AM WAT, April 9, 2024.

- The second edition of TechCabal’s Moonshot Conference is set for October 9–11, 2024, at the Eko Convention Centre, Lagos, Nigeria. Moonshot will assemble Africa’s biggest thinkers, players and problem solvers on a global launchpad for change. If you want to join the stakeholders in Africa’s tech ecosystem for three days of insightful conversations, then get an early-bird ticket at 20% off.

- Nigeria’s biggest women-only festival, Hertitude, is back for a third time. For those new to the scene, Zikoko brings all the girls to the yard every year to let their hair down, form bonds and celebrate what it means to be a hot babe. It’s happening on April 20, 2024, in Lagos and will feature everything from talent shows and karaoke sessions to spa services, live music performances and an afterparty. Click here to get tickets.

- Attention all music lovers! On Saturday, May 11, 2024, Zikoko wants you outside for a day of link-ups, games, drinks and live performances at Muri Okunola Park, Lagos. Strings Attached is an opportunity for friends to reconnect, lovers to bond and individuals to make friends and build community. To get a free ticket, download the Onebank by Sterling App and sign up using ZIKOKO as the referral code. You’ll get your ticket in your email once tickets are available. Click here to get the app.

Here’s what you should be looking at

Written by: Mariam Muhammad, Towobola Bamgbose & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/l4Y1Uw7

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon