Happy pre-Friday

LinkedIn is trying out TikTok-style videos.

It’s not set in stone yet, but the company has confirmed that users will be seeing short-form video feeds in the near future. The app joins a string of other apps like X (Twitter), Reels, and Snapchat that are proving that what’s good for the goose, might also be good for Uganda.

Ethiopia’s biggest bank recovers 80% of $14 million lost in system glitch

Ethiopia’s biggest bank, the Commercial Bank of Ethiopia (CBE), has made significant strides in recent years. With over 46 million account holders and 82 years of experience, the CBE oversees the country’s financial sector. However, even giants stumble.

A glitch in the CBE system allowed for free cash withdrawals at ATMs and electronic transfers, losing up to $14 million in the process.

For thousands of Ethiopians, especially university students, March 16 was unlike any other day. A technical problem during routine “maintenance and inspection activities” led to the glitch. News spread quickly; over 15,000 people took advantage of the glitch, with withdrawals ranging from 9 cents to over $5,000.

Currently, the CBE has recovered 80%— about $11 million of the money lost in its glitch. While nearly 15,000 Ethiopians have willingly returned the extra funds they withdrew, the bank has reportedly released the names and account details of the remaining 567 individuals in an attempt to shame them into giving it back.

According to Abe Sano, the president of the CBE, the outstanding amount is insignificant to the bank, but not collecting it sends the wrong message.

Zoom out: 490,000 transactions were reportedly conducted before the CBE detected the glitch. News of the glitch initially spread particularly amongst university students, prompting universities nationwide to urge their students to return any extra funds they received.

Experience fast and reliable personal banking with Moniepoint

Give it a shot like she did  . Click here to experience fast and reliable personal banking with Moniepoint.

. Click here to experience fast and reliable personal banking with Moniepoint.

BoU downgrades Guarantee Trust Bank Uganda to Tier II Institution

In a bid to strengthen Uganda’s banking system and make it more resilient to external shocks, the Ugandan government implemented stricter capital requirements for financial institutions in July 2023.

The Ugandan government, through its finance ministry, implemented new regulations that require commercial banks to hold a minimum of $38.6 million in capital reserves. This is a 506% increase from the previous requirement of $6.4 million. Banks have until June 30, 2024, to comply with the new rules.

As a result, some banks have downgraded operations. Guaranty Trust Bank Uganda Ltd, a subsidiary of Nigeria’s Guaranty Trust Bank, applied to be downgraded from a commercial bank to a credit institution following anticipated failure to meet the new capital buffer requirements.

Uganda’s apex bank granted the request and demoted Guaranty Trust Bank (GTBank) from a Tier I commercial bank to a Tier II credit institution which has a minimum capital requirement of $275,802. This change also affects Kenya’s ABC Capital Bank and Opportunity Bank.

As a result of the downgrade, these banks are restricted to accepting customer deposits and maintaining savings accounts. However, they are no longer permitted to open current accounts for customers or engage in foreign currency trading.

South Africa’s richest Black man, Patrice Motsepe, enters talks for Canal+ bid on MultiChoice

Since 2020, French broadcasting company, Canal+ has increased its stake in MultiChoice, Africa’s pay-TV giant from 20.1% to 35.01% and made an offer in February 2023, to buy Multichoice’s remaining shares for R105 per share. The offer was deemed too low by Multichoice and was rejected.

Earlier this month, Canal+ increased its offer to R125 per share—a 20% increase from the initial offer of R105—a week after a regulatory panel mandated the French broadcaster to make an offer to MultiChoice’s ordinary shareholders and extended the offer deadline to April 8, 2024.

Although both companies agreed to cooperate following the offer increase, the bid for MultiChoice just got a whole lot more interesting.

Why? Patrice Motsepe, president of the Confederation of African Football and South Africa’s wealthiest Black man, reportedly worth $2.4 billion, is entering talks to join Canal+’s bid. According to Bloomberg, the discussions are still at an early stage and there is no guarantee that an agreement will be reached.

Motsepe, who founded Ubuntu-Botho Investments and African Rainbow Capital (ARC), also holds investments in mobile network operator, Rain and neobank, TymeBank.

Why is this important? Canal+ might only be able to hold a maximum of 20% of voting rights, a major hurdle due to South African regulations that limit foreign ownership of broadcasters to 20%. Motsepe’s involvement in the deal could ensure MultiChoice remains a South African entity, meeting the local ownership threshold required by authorities.

No hidden fees or charges with Fincra

Collect payments via Bank Transfer, Cards, Virtual Account & Mobile Money with Fincra’s secure payment gateway. What’s more? You get to save money for your business when you use Fincra. Start now.

ByteDance pulls the plug on LetsChat

In 2021, ByteDance, makers of TikTok brought the fight to WhatsApp and Telegram on the continent through its messaging platform: Let’sChat. Launched in March 2021, LetsChat allowed users similar capabilities to other messaging platforms: text, voice call, and video call.

While experts gave the budding messaging platform little or no chance of displacing established rivals like WhatsApp on the continent, Let’sChat forged on, amassing over 7 million users in the process with a bulk of them from Nigeria and others from Mali, Angola, and Côte d’Ivoire.

To set itself apart from the market, Let’sChat heavily advertised itself as a data-saving platform, offering free video and voice calls to its users. The feature was a great incentive for Nigerians where internet subscription prices are among the most expensive in the world. Let’s Chat also engaged major Nigerian influencers to board people onto the platform.

Unfortunately, it wasn’t enough. While the app had gathered about 440,000 monthly average users (500 times fewer than WhatsApp’s), downloads fell after it struggled to keep users glued after its dramatised launch.

ByteDance seems to have given up the chase on WhatsApp and is now pulling the plug on LetsChat to “focus on other priorities”.

The news: Per reporting from Rest of World, ByteDance has shut down LetsChat. According to a note on LetsChat website, the platform was shutdown on March 23. Per the website statement, LetsChat’s mobile app was removed from various app stores on February 26.

The website has announced that “all reward tasks will stop.” However, “completed tasks will be distributed in the form of credit” to users’ wallets, urging them to keep an eye on their balance.

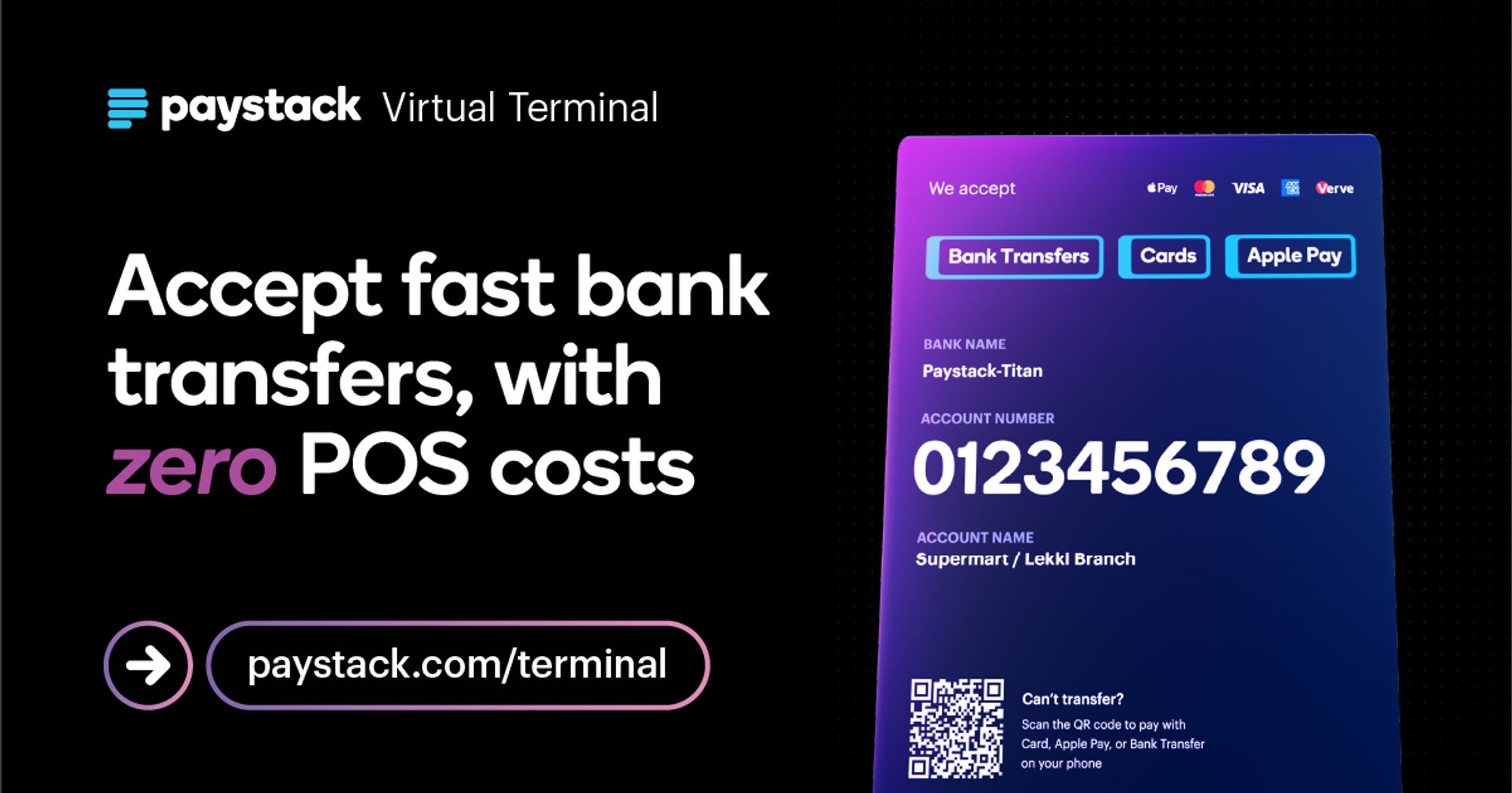

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

Telecom Egypt partners Tejas to improve local manufacturing

Telecom Egypt isn’t holding back!

Recently, the mobile operator has been making huge power plays. In January, the telecom was Egypt’s first mobile operator to obtain a 5G licence, acquiring a 15-year, $150 million licence.

In February 2024, it partnered with 4iG, a Hungarian IT solutions provider, to build an express subsea cable that’ll connect Albania to Egypt. Upon completion, the subsea cable is expected to connect Africa and Asia to Europe through Egypt, the Mediterranean, and Albania.

The news: The telecom is buddying up with Tejas Networks, an Indian broadband, and data networking products company, to create job opportunities for Egyptians through telecom and research skill development. Tejas Network will also set up technical support services in Egypt as part of the collaboration arrangement to help clients in Egypt and throughout the larger Africa and Middle East area.

Tejas Network’s experience in implementing projects like the Nigerian Rural Broadband project and India’s National Knowledge Network project—estimated to have impacted India’s ~550 million young population—positions it as a top trainer for Egyypt’s learners.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $69,320 |

– 1.15% |

+ 21.77% |

|

| $3,512 |

– 2.26% |

+ 10.74% |

|

|

$0.09997 |

– 0.03% |

– 0.09% |

|

| $574.23 |

– 0.79% |

+ 43.59% |

* Data as of 10:42 PM WAT, March 27, 2024.

Experience the best rates and enjoy swift 6-24hrs delivery times. Elevate your business with OneLiquidity–get started today.

- Ride-hailing platform, Bolt has launched an Accelerator Programme for its drivers and riders in Kenya. The program will see the company invest €20,000 (about Ksh2.92 million) in seed funds to support business plans developed by Bolt drivers and couriers or their family members that link to sustainable transport. Apply by April 4.

- The Corporate Social Responsibility arm of MTN Nigeria, MTN Foundation has opened applications for phase two of its “Yellopreneur” Initiative, through which it intends to offer 150 female entrepreneurs with ₦3 million ($1,900) each as loans to boost their businesses. Apply by March 30.

- Applications are open for the Access Bank Youthrive Program for Nigerian MSMEs. The program is a collaboration between the bank and the Vice President’s office, dedicated to empowering individuals and MSMEs. With a focus on capacity development, financial empowerment, and business exchange, the program aims to impact 4 million youths over the next four years. Apply here.

- The 2024 African Business Heroes Competition is open for application. It aims to identify, support, and inspire the next generation of African entrepreneurs who are making an impact in their local communities, working to solve the most pressing problems, and building a more sustainable and inclusive economy for the future. Finalists get grant funds of up to $300,000, global recognition and exposure and targeted and practical training programs. Apply by May 19.

Here’s what you should be looking at

- Benjamin Oyemonlan is creating a protean payment platform at Platnova

- Access Holdings’ Hydrogen posts first profit in two years

- Kenya Airways cuts down losses, records first operating profit in years

- Starlink terminals are falling into the wrong hands

- African B2B e-commerce giant Wasoko marked down to $260M after VC halves stake

Written by: Mariam Muhammad & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

from TechCabal https://ift.tt/SOxeprX

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon