Chances are you have already seen an ad from your bank to download their app which will basically change your life (and banking as you know it). If not an ad, then someone must have asked you in the banking hall (or during one of those things when they drive a truck around blaring extremely loud music) if you have downloaded their app and offer to set it up for you – again, so that your life can change.

But what is all the fuss about? Some people will say these Nigerian mobile bank apps are just feature repositories for banks to outdo each other in the struggle for consumer attention. Even worse is the extent to which they all replicate several features with little innovation or differentiation. How well that’s working is talk for another day.

But na so we see am, So I took it upon myself (just like I did with Google Tasks v Any.do) to test out these apps to see what’s what (but mostly to confirm if my life will actually change). Keep in mind that Nigerian apps have a very, very, bad rep, historically. People (including me) just tend to NOT trust them for some reason.

Anyway, for the better part of the past month, I’ve used both Zenith Bank’s EazyMoney iOS app and Access Bank’s AccessMobile iOS app extensively (on my two-year-old iPhone 6 Plus) as a “millennial” Nigerian living and working in Lagos, Nigeria. Here are my findings:

The Experience

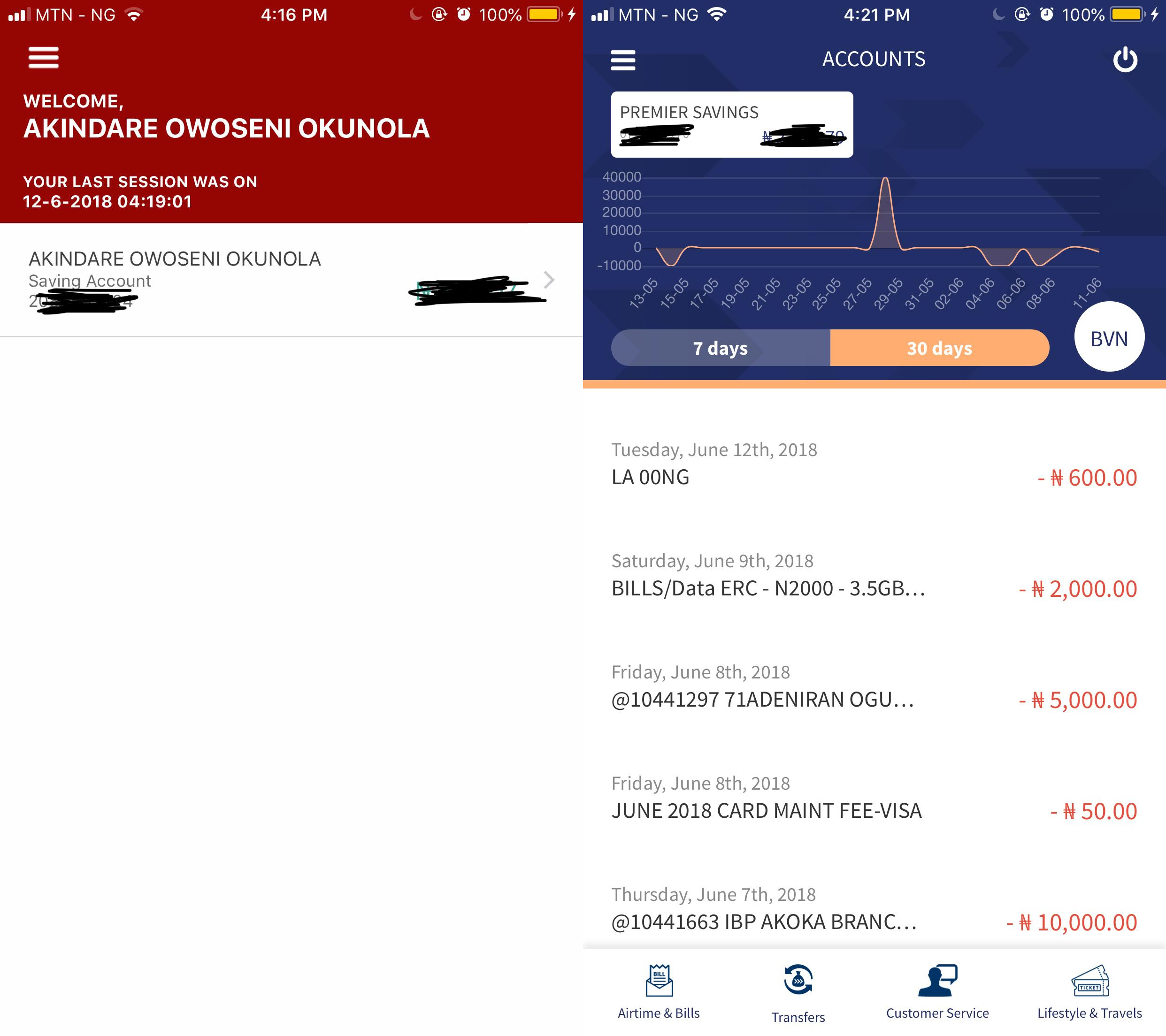

The first thing anyone will notice about these apps is that they have very different design ethos. The Zenith Bank app is much flatter with less animations and an overall ‘un-emotive’ design while the Access Bank apps’ design is much more robust with a lot of animations, colors, and cool iconography. Design-wise, the EazyMoney app is leagues behind AccessMobile.

That said, EazyMoney’s simpler design makes it a much more nifty app to use. It loads way faster than the AccessMobile app, is less cluttered and way more functional. Not that the AccessMobile isn’t functional; it just has a lot more going on so transactions tend to take longer than they would compared to the EazyMoney app.

For example, the AccessMobile app has an arrow-thing transition between when you select an option on the secondary menu (the primary menu only shows your account overview with options for airtime recharge, transfers, customer service and “lifestyle & Travels”) and when the third menu beyond that appears. It’s cool to look at but it most certainly doesn’t get my transaction done faster.

Interestingly, AccessMobile’s inferior accessibility doesn’t really affect usage (unless when the Internet is bad – those arrow-thing animations can drive one crazy). I suspect this is because Nigerians typically don’t use their apps to do ‘quick’ banking actions. Most people have told me that they would mostly likely set out time to do things as basic as transfers, as opposed to using their bank app for the same action on the go – while shopping or running errands, for example.

And I do fall into that category. For on-the-go banking actions (airtime etc), I typically use USSD while bank apps are for other actions (usually when I’m moving money between accounts). That means I enjoy the experience – if you could call it that – more when I use AccessMobile, compared to when I use EazyMoney.

Usability

Both these apps do the majority of what you’d expect any bank app to offer. Typical features that cut across both apps are: account overview, money transfers, airtime recharge, bill payments PHCN, cable TV etc), cards and cheque management (requests etc), travel and lifestyle (plane tickets, hotel bookings, movie tickets etc) and messages (or notifications).

For the most part, all of these features work as advertised – although I didn’t try a lot of them (hotel booking, bill payment and card/cheque management, for example). The meat of the matter here are the things that they do (or don’t do).

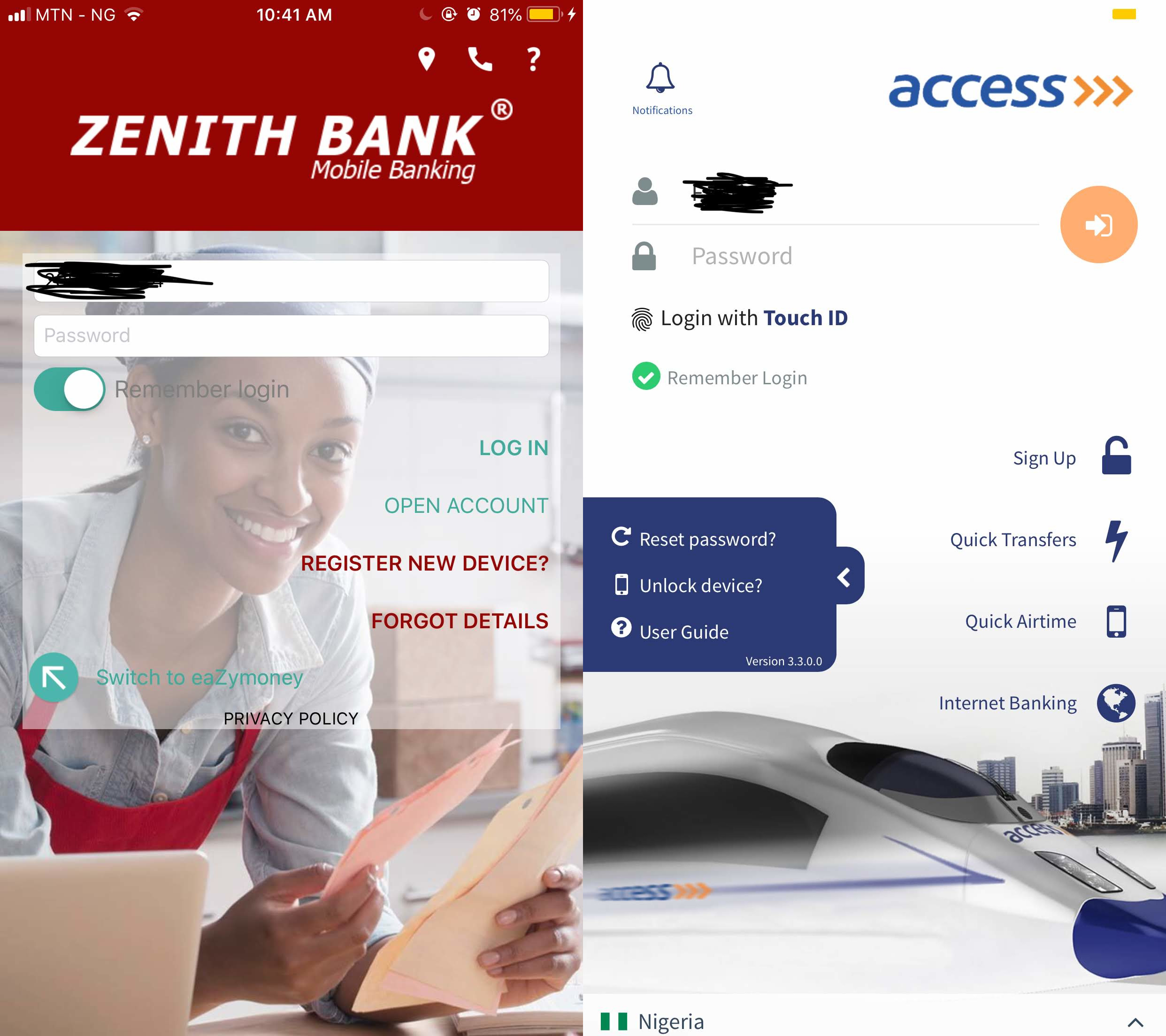

A great example is using Touch ID to sign in. AccessMobile claims to support it (it’s right there on the sign-in page) but I’ve never been able to get it to work. I confirmed this is not an isolated issue too – from four other people. Even more curious is the fact that AccessMobile has ‘supported’ Touch ID sign-in longer that EazyMoney which – yes, you guessed it – lets you sign-in with Touch ID.

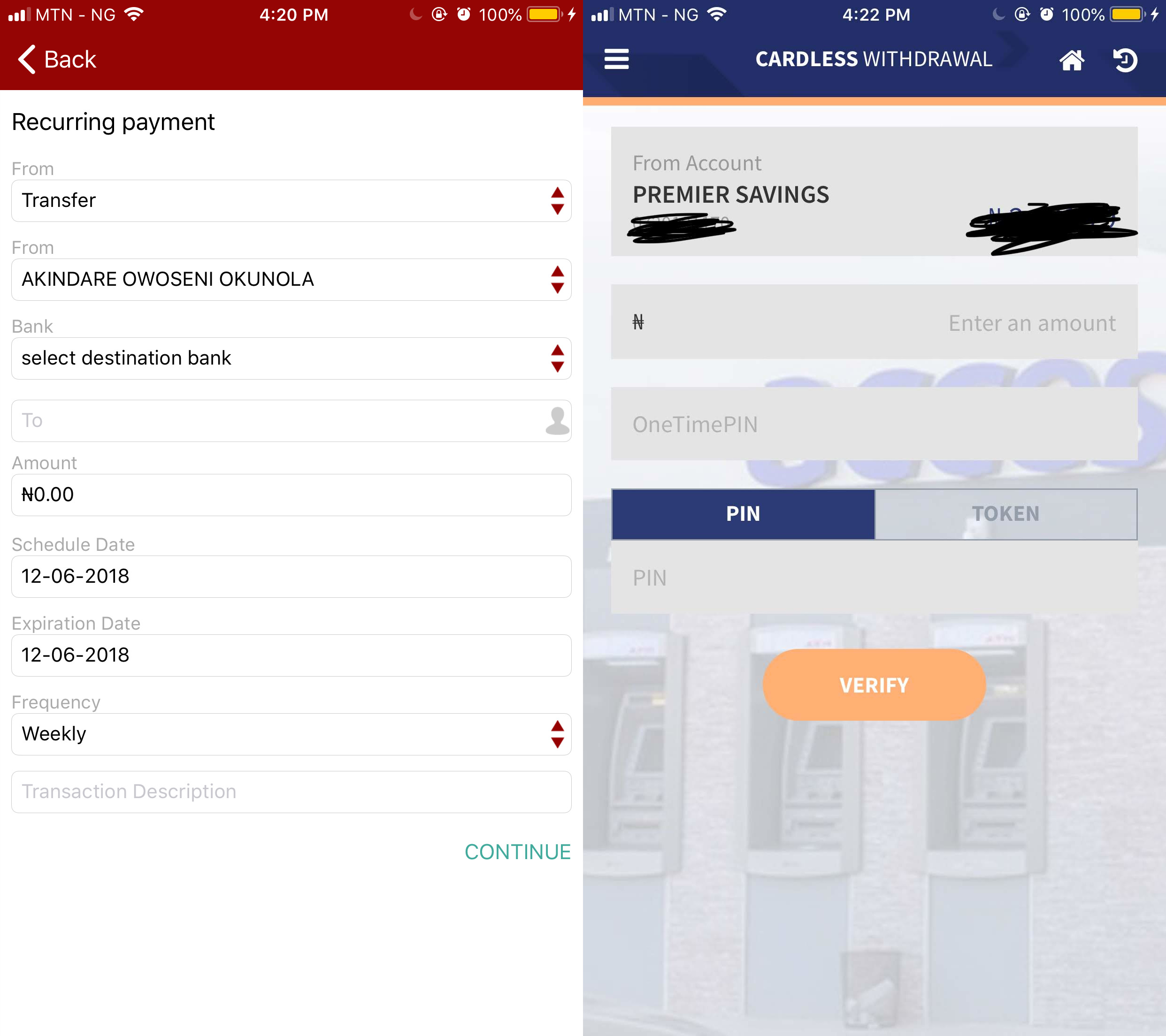

Another example is the cardless withdrawal feature on AccessMobile. My younger sister actually put me on to this when I lost my wallet a few months back and at first I thought she was just yanking my chain. But as per journalist, I tried it out and guess what? It worked! Many times! All you have to do is click the cardless withdrawal button in the app, enter an amount, a one time pin, your PIN/token number, follow the prompts on the ATM (after you’ve selected cardless withdrawal, of course) and voila! Money will come out. It’s super cool when there are a lot of people waiting to use the ATM, don’t judge me.

Other Stuff You May Want To Know

EazyMoney has a bank locator feature that will show you nearby Zenith Bank branches. It also has a recurring payment feature which is very useful; it lets you set recurring payments to any account in any Nigerian bank at specified frequencies (weekly, monthly etc).

AccessMobile allows you contact your account officer through the app and access some customer service functions as well. It also has a few “Quick” features on the sign-in page that you can use before you sign in to the app. They include “Quick Airtime” (allows you recharge up to N5K daily), “Quick Transfers” (lets you transfer a maximum of N20K daily), and “Internet Banking” (opens your phone’s browser to access the bank website).

And The Winner Is …

AccessMobile. As a whole, the experience with the AccessMobile app is just better. While EazyMoney’s recurring payments feature is quite compelling, saving (Piggybank.ng has that covered) is the only recurrent thing I have going on outside of data, food and fuel. The bank locator function is great as well but I definitely do not want to go into the bank for any reason if possible.

The AccessMobile app on the other hand is not just better designed but it also packs more features, in my opinion. That cardless withdrawal thing saved my ass so many times and the quick transfer/airtime feature is mad intuitive. These, among other reasons, are why the AccessMobile app takes this battle. Dazall!

The post Versus – The Bank App Edition: Zenith VS Access appeared first on TechCabal.

from TechCabal https://ift.tt/2LGz8Bt

via IFTTT

Write your views on this post and share it. ConversionConversion EmoticonEmoticon